|

Brussels, 14.10.2020 SWD(2020) 953 final

PART 1/5

COMMISSION STAFF WORKING DOCUMENT

Clean Energy Transition – Technologies and Innovations

Accompanying the document

REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT AND

THE COUNCIL

on progress of clean energy competitiveness

{COM(2020) 953 final}

Clean Energy Transition – Technologies and Innovations

Report (CETTIR)

CONTENTS

CLEAN ENERGY TRANSITION – TECHNOLOGIES AND INNOVATIONS REPORT (CETTIR) 1

- INTRODUCTION………………………………………………………………………………………… 4

- OVERALL COMPETITIVENESS OF THE EU CLEAN AND LOW CARBON

ENERGY SECTOR……………………………………………………………………………………… 6

- Macroeconomic competitiveness analysis………………………………………………… 6

- Share of EU energy sector in EU GDP……………………………………………………. 8

- Human capital…………………………………………………………………………………….. 12

- Research and innovation investments……………………………………………………. 15

- FOCUS ON KEY CLEAN ENERGY TECHNOLOGIES AND SOLUTIONS.. 18

- Introduction – Energy system trajectories to the time horizons 2030 and

2050………………………………………………………………………………………………….. 18

- Offshore renewables – Wind………………………………………………………………… 24

- State of play of the selected technology and outlook………………….. 25

- Value chain analysis……………………………………………………………….. 38

- Global market analysis…………………………………………………………….. 47

- Future challenges to fill technology gap…………………………………….. 53

- Offshore renewables – Ocean……………………………………………………………….. 56

- State of play of the selected technology and outlook………………….. 56

- Value chain analysis……………………………………………………………….. 65

- Global market analysis…………………………………………………………….. 71

- Future challenges to fill technology gap…………………………………….. 73

- Solar Photovoltaics……………………………………………………………………………… 74

- State of play of the selected technology and outlook………………….. 74

- Value chain analysis……………………………………………………………….. 83

- Global market analysis…………………………………………………………….. 91

- Future challenges to fill technology gap…………………………………….. 93

- Renewable hydrogen through electrolysis………………………………………………. 94

- State of play of the selected technology and R&I landscape……….. 94

- Value chain analysis……………………………………………………………… 104

- Global market analysis…………………………………………………………… 106

- Future challenges to fill technology gap…………………………………… 106

- Batteries…………………………………………………………………………………………… 107

- State of play of the selected technology and R&I landscape……… 107

- Value chain analysis……………………………………………………………… 120

- Global market analysis…………………………………………………………… 125

- Future challenges to fill technology gaps…………………………………. 130

- Buil dings (incl. heating and cooling)……………………………………………………. 132

- Prefabricated building components…………………………………………. 133

- Energy efficient lighting………………………………………………………… 139

- District heating and cooling industry………………………………………. 145

- Heat pumps………………………………………………………………………….. 152

- Carbon Capture and Storage………………………………………………………………. 157

- State of play of the selected technology and outlook………………… 157

- Value chain analysis……………………………………………………………… 171

- Global market analysis…………………………………………………………… 173

- Future challenges to fill technology gap…………………………………… 175

- Geothermal………………………………………………………………………………………. 175

- State of play of the selected technology and outlook………………… 175

- Value chain analysis……………………………………………………………… 185

- Global market analysis…………………………………………………………… 192

- Future challenges to fill technology gap…………………………………… 194

- High Voltage Direct Current……………………………………………………………… 195

- State of play of the selected technology and outlook………………… 198

- Value chain analysis……………………………………………………………… 205

- Global market analysis…………………………………………………………… 210

- Future challenges to fill technology gap…………………………………… 212

- Hydropower……………………………………………………………………………………. 213

- State of play of the selected technology and outlook………………… 213

- Value chain analysis……………………………………………………………… 221

- Global market analysis…………………………………………………………… 224

- Future challenges to fill technology gap…………………………………… 226

- Industrial heat recovery…………………………………………………………………….. 227

- State of play of the selected technology and outlook………………… 227

- Value chain analysis……………………………………………………………… 247

- Global market analysis…………………………………………………………… 250

- Future challenges………………………………………………………………….. 252

- Nuclear energy…………………………………………………………………………………. 253

- State of play of the selected technology and outlook………………… 253

- Value chain analysis……………………………………………………………… 263

- Global market analysis…………………………………………………………… 266

- Future challenges to fill technology gap…………………………………… 271

- Onshore wind………………………………………………………………………………….. 273

- State of play of the selected technology and outlook………………… 273

- Value chain analysis……………………………………………………………… 277

- Global market analysis…………………………………………………………… 281

- Future challenges to fill technology gap………………………………….. 283

- Renewable fuels………………………………………………………………………………. 284

- State of play of the selected technology and outlook………………… 284

- Value chain analysis……………………………………………………………… 292

- Global market analysis………………………………………………………….. 298

- Future challenges to fill technology gap………………………………….. 301

- Solar thermal power………………………………………………………………………….. 303

- State of play of the selected technology and outlook………………… 303

- Value chain analysis……………………………………………………………… 309

- Global market analysis………………………………………………………….. 310

- Future challenges to fill technology gap………………………………….. 310

- Smart Grids – Digital infrastructure…………………………………………………….. 311

- Smart Grids in the energy transition……………………………………….. 311

- Investment in Smart Grids & digital infrastructure…………………… 313

- Digital infrastructure for O&M of the Grid……………………………… 317

- Digital infrastructure for flexibility management in the grid………. 322

- Future challenges………………………………………………………………….. 331

- Citizen and community engagement…………………………………………………… 333

- Citizen and community engagement in the Energy transition –

status and outlook………………………………………………………………… 334

- Technical and regulatory barriers & possible solutions………………. 336

- Social and behavioural barriers and key elements from science,

research and innovation to address them…………………………………. 337

- R&I to further develop citizen and community engagement………. 339

- Challenges…………………………………………………………………………… 340

- Smart cities & communities……………………………………………………………….. 341

- Introduction………………………………………………………………………… 341

- Current situation and outlook………………………………………………… 342

- Value chain analysis……………………………………………………………… 342

- Global Market analysis………………………………………………………….. 344

- Challenges…………………………………………………………………………… 344

- CONCLUSIONS ……………………………………………………………………………………… 345

- LIST OF MISSING INDICATORS FOR SPECIFIC

TECHNOLOGIES/TOPICS………………………………………………………………………. 351

LIST OF ACRONYMS…………………………………………………………………………………….. 353

The Clean Energy Transition – Technologies and Innovations Report (CETTIR) is the underpinning analysis to the first annual Competitiveness Progress Report[1] (CPR) based on the results of the Low Carbon Energy Observatory[2]. It includes all the data supporting the arguments made in the Progress Report, as well as assessment of further key clean and low carbon energy technologies[3]. Further technologies will be addressed in future Competitiveness reports.

There are various definitions of competitiveness in the literature[4], while “there is no single indicator that captures the essence of its meaning for an economy”[5]. For the purpose of this report, competitiveness of the clean energy sector is understood as “the capacity to i) produce affordable, reliable and accessible clean energy through clean energy technologies; ii) use clean energy productively; and iii) compete in energy and energy technology markets, with the overall aim of bringing benefits to the EU economy and people”.

The present Staff Working Document is structured in the same way as the CPR, and analyses competitiveness of the European clean and low carbon energy sector as follows:

- Macroeconomic analysis assessing the overall competitiveness of the European clean and low carbon energy sector (part 2)

- Analysis assessing the competitiveness of 18 clean and low carbon energy technologies and cross cutting topics (part 3)

The analysis is based on a range of competitiveness indicators, which are analysed through three steps:

- Technology analysis – state of play and outlook

- Value chain analysis

- Global market analysis by comparing it with other key regions (e.g. US, China, Asia without China)

| EU’s clean energy industry’s competitiveness | ||

| 1. Technology analysis Current situation and outlook | 2. Value chain analysis of the energy technology sector | 3. Global market analysis |

| Capacity installed, generation

(today and in 2050) |

Turnover | Trade (imports, exports) |

| Cost, Levelised Cost of Energy (LCOE)

(today and in 2050) |

Gross value added growth Annual, % change | Global market leaders vs. EU market leaders

(market share) |

| Current Public R&I funding | Number of companies in the supply chain, incl. EU market leaders | Resource efficiency and dependence |

| Current Private R&I funding | Employment | Real Unit Energy Cost[6] [7] |

| Current Patenting trends | Energy intensity / labour productivity | |

| Current level of scientific Publications | Community Production[8]

Annual production values |

|

Competitiveness is a multi-dimensional concept, which can be applied and measured at different levels of economic analysis. Nonetheless, it is always conceived, and evaluated, in comparison to the performance of others. The majority of existing competitiveness indices are composite indicators built on a number of variables. They address countries or geographical areas (i.e. Europe) rather than the EU as one entity and cover the entire economy and not specific sectors (i.e. low-carbon industry). The indices and underlying datasets are not always available at the desired level of granularity, or consistently updated.

Ideally, competitiveness indicators should:

- focus on the most relevant dimensions of industrial competitiveness and cover all sectors and markets open to competition;

- be straightforward and – as far as data is available – allow comparison of the EU with global trading partners based on robust and timely statistical data.

In practice, none of the competitiveness indicators encountered in literature can fulfil all these criteria. Following a review of frameworks and datasets[9], the above indicators have been chosen for consideration in this first report, as more relevant to the competitiveness of the low-carbon industries.

Data availability remains the major limitation for the analytical evaluation of competitiveness and its quantification through a set of indicators. Existing data classifications often do not differentiate between low-carbon or conventional energy activities. In addition the definition of what ‘low-carbon’ or ‘clean energy’ entails differs across literature and data sources, and thus the group of actors covered, and underlying estimation methods also differ.

Future work could improve on the selection of indicators, were needed, and address the quality, coverage and consistency of data sources that underpin them. The indicators could be further grouped so as to focus on specific aspects of competitiveness. The construction of an index may be helpful in monitoring progress though a single metric.

- Overall Competitiveness of the EU clean and low carbon energy sector

The European Green Deal aims at transforming the European economy by decoupling the growth and the use of resources, and reaching carbon neutrality by 2050[10]. This context requires a new focus on the relationship between research and innovation activities and technologies’ competitiveness which will enable to reach the EU Green Deal objectives. The better understanding of the role of technology evolution, within the transition period, allows to identify potential technology gaps and resource constraints in order to fully reap the competitive advantage of the energy transition.

The speed and the effectiveness of the European innovation cycle in delivering the solutions required by the transformation will steer the competitiveness of the EU industrial system and its place in the world, as well as the EU’s economic recovery from the Covid-19 pandemic. The European Commission’s Communication “A Clean Planet For All”[11], strongly calls for putting in place a “forward-looking research and innovation strategy” with R&I addressing longer time perspectives.

The section below includes the macroeconomic indicators not covered by the CPR[12], followed by an analysis of 18 clean and low carbon energy technologies, solutions and cross cutting topics.

- Macroeconomic competitiveness analysis

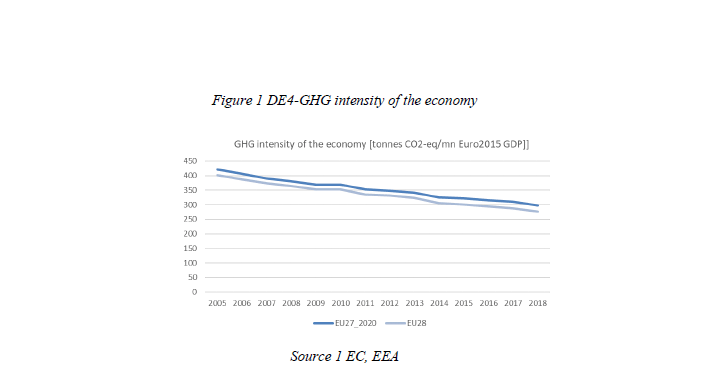

The greenhouse gas (GHG) intensity of the EU economy has been decreasing by nearly 30% since 2005, while the EU economy has continued to grow. In 2018, this indicator was just under 300 tonnes of CO2 equivalents per million Euro of GDP, which is half of the value recorded for 1990.

|

||

|

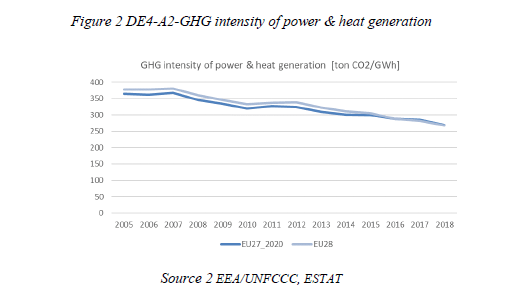

Similarly, the relative decrease in the GHG intensity for the power and heat generation sector in the 2005-2018 period was 26%. The 2018 intensity for the sector, of near 270 tons CO2 per GWh, is 44% lower than the 1990 reference value.

Source 2 EEA/UNFCCC, ESTAT

Greenhouse gas emissions continue to decrease in absolute terms, per capita and per Euro generated in the economy. Most sectors, and particularly energy supply, industry and residential, reduced emissions; transportation is a notable exception where demand outpaces climate- policy benefits. Emissions have decreased in parallel with increasing GDP, confirming that attempts to mitigate climate change do not necessarily conflict with a growing economy, but much faster emission reductions will be needed to achieve climate neutrality by 2050[13].

- Share of EU energy sector in EU GDP

Overall, in 2017, in the EU economy the biggest sectors in terms of turnover were wholesale and retail trade (EUR 8.7 trillion), manufacturing (EUR 7.2 trillion), and construction (EUR 1.4 trillion)[14]. In this context, energy represented EUR 1.8 trillion in 2018. Turnover from renewable energy sources in EU27 was EUR 0.146 trillion in 2018, up from EUR 0.127 trillion in 2011[15] [16] [17].

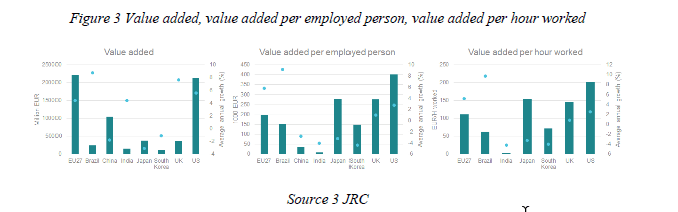

EU27 value added in the energy utilities sector16,17 was the highest in the world at EUR 221 billion in 2014, with US second at EUR 212 billion. Average annual growth at 4.4% (20002014) in value added of the energy utilities sector[18] falls behind Brazil (8.7%), UK (7.6%), and US (5.6%). However, when looking at value added per employee (growth of 5.8%) or per hour worked (5.2%), EU27 has improved the most from 2000 to 2014, second only to Brazil (9.2% and 9.7%).

| Figure 3 Value added, value added per employed person, value added per hour worked

Source 3 JRC |

Productivity had increased while labour intensity has decreased in the period between 2000 and 2014. This can be explained by capital investments improved productivity[19]. Labour- intensity has decreased also in Brazil, in Japan and in the US. In China, India, South Korea and UK it has increased. In absolute terms, EU27 value added per employee has increased from EUR 109 706 to EUR 198 231. In absolute terms US had the highest value added per employee in 2014 standing at EUR 401 257. EU27 value added per hour worked has increased from EUR 64 to EUR 110 (2000-2014), with US having highest level at EUR 202 per hour in 2014.

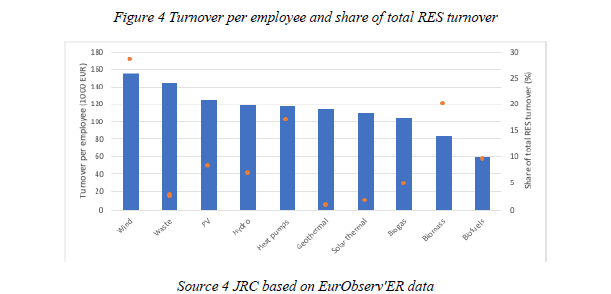

Labour productivity has increased in clean energy sector. However, productivity (turnover per employee) varies significantly among EU27 MSs between technologies, from EUR 155 000 in wind energy to EUR 59 000 in biofuels[20]. Main contributors to total RES turnover are wind (28.5%), biomass (20.1%) and heat pumps (16.9%), while highest turnover per employee is wind, waste and solar PV, in 2017-2018.

| Figure 4 Turnover per employee and share of total RES turnover

Source 4 JRC based on EurObserv’ER data |

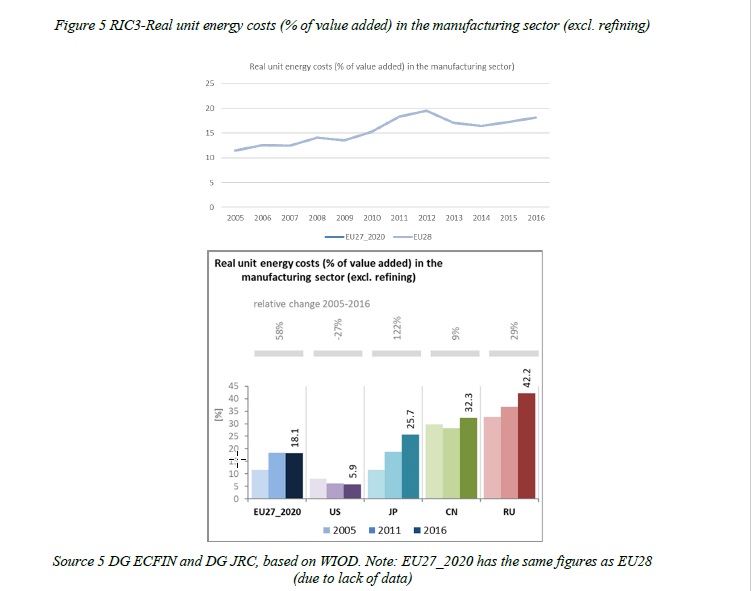

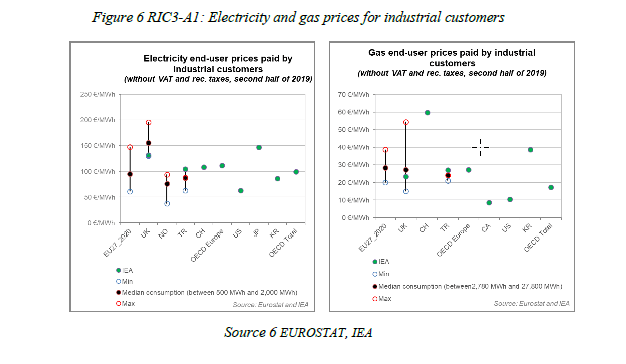

As outlined in the Price and Cost report[21], following an increase between 2005 and 2012, real unit energy costs in the EU have stabilised towards 2016 at about 18% of the value added in the manufacturing sector[22]. Even though this is a considerable change relative to 2005 (58% increase), with the exception of the US, the share remains lower than in other major economies. Real unit energy costs are mostly influenced by two main drivers: energy prices and energy efficiency measures implemented. Electricity and gas prices for industrial consumers vary within the EU.

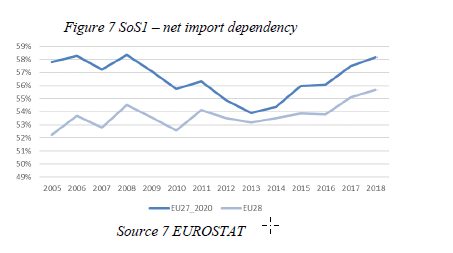

Despite a short-term improvement and reduction of energy import dependency between 2008 and 2013, there has since been an increase for the EU27[23]. In 2018 net import dependency was 58.2%, just over the 2005 level, and almost equalling the highest values over the period. Although the fossil fuel extraction in the UK has kept net import dependency lower for the EU28, in absolute terms, it has not meaningfully changed the increasing trend recorded since 2013.

Electricity and gas prices for industrial consumers vary within the EU and, on average, the EU seems to have an advantage versus some major economies and a disadvantage compared to others.

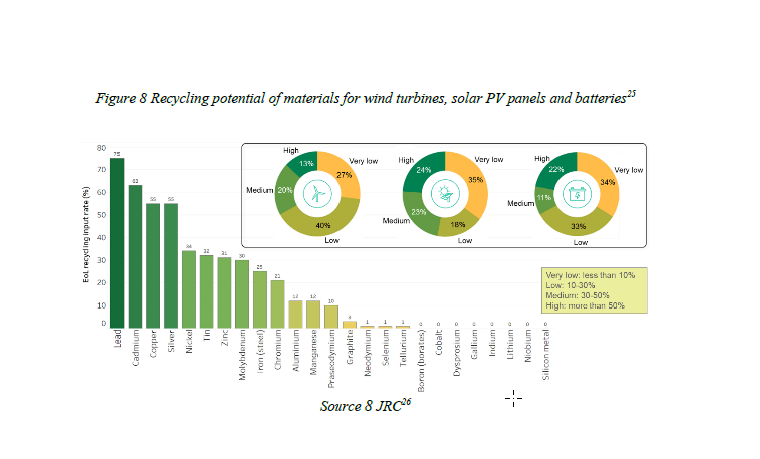

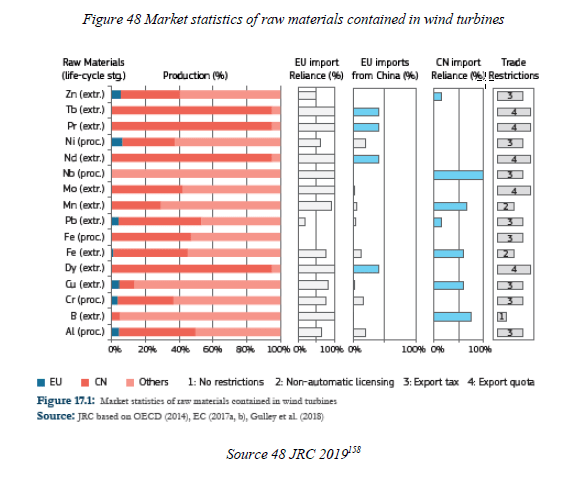

While clean energy technologies reduce fossil fuel dependence, and associated economic and environmental impacts, they are not free from similar issues related to the resources (raw materials) needed for their deployment. However, unlike fossil fuels, raw materials have the potential to stay in the economy through extended value chains and recycling, impacting the capital expenditures but not the operational expenditures of a project.

The EU depends strongly on other countries for raw and processed materials, and often also for components and final products. It is however an important producer of high technology components. While the market for base materials is well diversified specific, often high-tech materials are only available from a handful of countries (e.g. China produces over 80% of the available rare earths for permanent magnet generators)[24]. This risks replacing fossil fuel dependence with dependence on raw materials. To address this risk, diversification of raw materials supply through sourcing from both in- and outside the EU, as well as resource efficiency and circular economy considerations will be key going forward. R&I can provide additional measures to decrease supply risks through e.g. substitution and increase resource efficiency and circularity.

| Source 8 JRC26 |

- Human capital

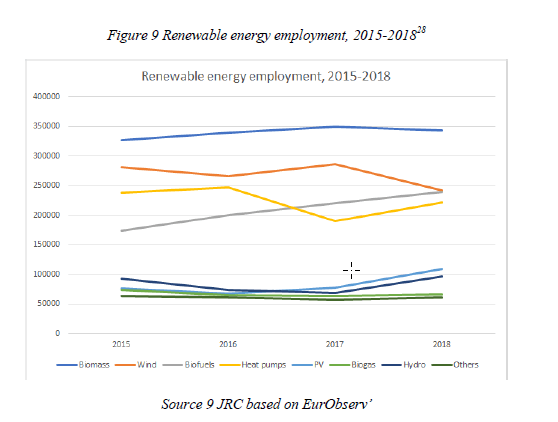

Direct employment in the clean energy sector has grown more than in the rest of the economy since 2000, despite slowing down and stagnating after the previous economic crisis. Particularly solar PV jobs experienced downturn as installation rates fell in the EU due to changes in the support scheme and manufacturing capacity concentrated to Asia. In the recent years jobs in solar PV have started to pick up again, growing 42% between 2015 and 2018. Employment in the wind sector has remained largely at similar levels between 2015 and 2018, although in recent years there have been weak signals of contraction in Germany, which is the biggest employer in the wind sector[25] [26] [27]. Employment has grown the most in biomass and biofuels. Overall, the biggest renewable energy sectors in EU27 in 2018 were biomass (344 100), wind (242 500), biofuels (239 600), and heat pumps (222 400).

Labour productivity (gross value added per employee) has improved significantly in the renewable energy sector. As a result of technological improvement, automation, and other innovation in the supply chain, more capacity can be added with fewer jobs. For example, in the US job intensity of solar PV has dropped from 101 jobs/MW in 2010 to 23 jobs/MW in 2017 . Decreasing trend is observable in EU as well for wind and solar PV .

Direct jobs in fossil fuel extraction and manufacturing activities have decreased from 410 000 to 328 000 in the period from 2011 to 2018 . Jobs in mining coal and lignite have decreased the most dramatically, falling from 215 935 in 2011 to 135 698 in 2018, and in extraction of crude petroleum and natural gas from 65 548 to 35 440 in EU27 during the same period. Decrease has been to some extent balanced by growth in manufacture of coke and refined petroleum products, and support activities. In the US jobs in mining of energy products have decreased from 246 000 to 195 000 (2010-2018), whereas jobs in manufacture of coke and refined petroleum products have remained at same levels at 113 000 in 2018[28] [29] [30] [31] [32].

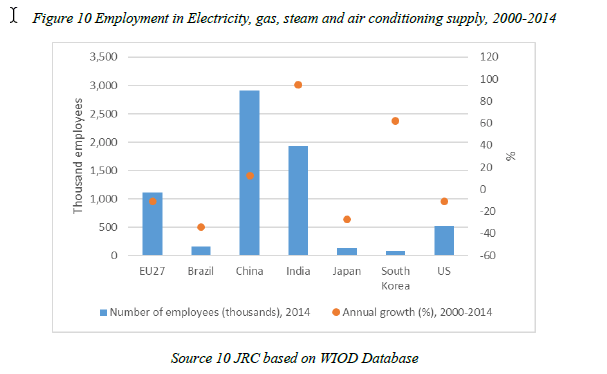

EU27 utilities sector employed 1 116 000 in 2014[33], decreasing annually by 10.7% since 2000. In contrast in China (12.4%), India (94.8%) and South Korea (62.1%), employment in utilities sector has increased during this period. In the US (-10.7%), Brazil (-34.3%) and

Japan (-27.0%) employment has decreased. In China and India the sector employs almost 3 million and 2 million people respectively.

| Figure 10 Employment in Electricity, gas, steam and air conditioning supply, 2000-2014

Source 10 JRC based on WIOD Database |

The green and digital transitions in the context of recovery from the COVID-19 pandemic is also impacting the EU energy sector in terms of availability of skilled workers. While the provision of education and training responses is ongoing, the greening energy sector continues to face challenges in terms of having enough workers with the required skill sets at the locations where they are in demand. Engineering and technical occupations, IT skills and ability to utilize new digital technologies, knowledge of health and safety aspects, specialised skills for carrying out work in extreme physical locations (e.g. at height or at depth), soft skills like team work and communication, as well as English language (due to having to work in international teams) are in high demand[34] [35].

From a gender point of view, on average in 2018, women were found to represent 46% of the administrative workforce, 28% of the technical staff, and 32% of senior management positions in clean energy companies . Women represented only 28% of STEM jobs in renewables.

For comparison, broad energy and energy efficiency sectors in the US employ 8.3 million people in 2019, comprising 5.4% of the US workforce. Production, transmission and distribution of fuels and electricity employed 3.3 million people, with 1.2 million working in traditional coal, oil and gas, while almost 740 000[36] workers were employed in low-carbon sector. Employment in the broad energy sector has grown 12.4% between 2015 and 2019, outpacing the general economy’s employment growth rate of 6%. In total, these sectors added nearly 915 000 jobs over the 2015-2019 period[37].

Recent figures showed slightly decreased gap compared to 2005[38] and there are signs that more women are entering as professionals in technical functions within the RE sector, although in the occupational trades there are still barriers often linked to stereotypes[39]. Given the slow progress to date in removing barriers to entry and career advancement, there is a risk that the clean energy sector will be deprived of a large share of its talent pool, unless effective, proactive gender-equity policies and programs are put in place[40]. Globally, women represent only 6% of ministerial positions responsible for national energy policies and programs, and account for less than a third of employees across fields within scientific research and development[41]. Better gender balance in male-dominated professions has been shown to improve well-being, work culture and productivity[42].

In terms of gender balance, in the US women represent about 31% across all fuel types, which is lower than the national workforce average 47%[43] [44].

- Research and innovation investments

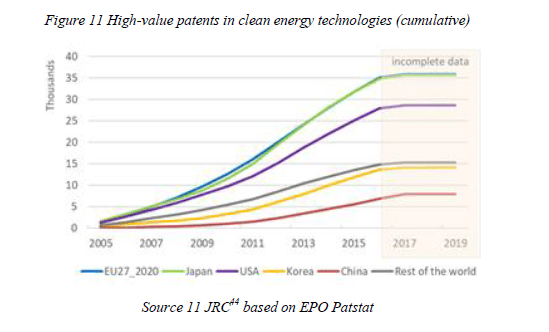

| Figure 11 High-value patents in clean energy technologies (cumulative)

Source 11 JRC44 based on EPO Patstat |

Smart systemsPatenting activity in clean energy technologies[45] peaked in 2012, but has been in decline since[46]. Within this trend, certain technologies of increasing importance for the clean energy transition (e.g. batteries) have maintained or even increased levels of activity. Clean energy patents account for 6% of all high-value inventions in the EU27. The share is similar for Japan, but higher than China (4%), the US and rest of the world (5%), and second only to Korea (7%) in terms of competing economies. The EU27 and Japan lead among international competitors in high-value[47] patents in clean energy technologies. However, the EU’s global positioning varies by technology. The EU27 has the highest share of high-value inventions, 60% seeking protection in more than one market; the US follows with 56% and Japan with 35%. In contrast, China’s exponential patent growth is almost exclusively domestic, with only 3% seeking international protection. In terms of specialisation, revealed as a higher share of inventions than the global equivalent, the EU performs better than the rest of the world in three of the Energy Union R&I priorities45. Namely, the EU maintains an – albeit shrinking – advantage in renewable technologies and CCUS, while increasing overall specialisation in sustainable transport technologies.

□ Energy efficiency

- Sustainable transport

- CCUS

- Nuclear safety

Source 12 JRC44 based on EPO Patstat

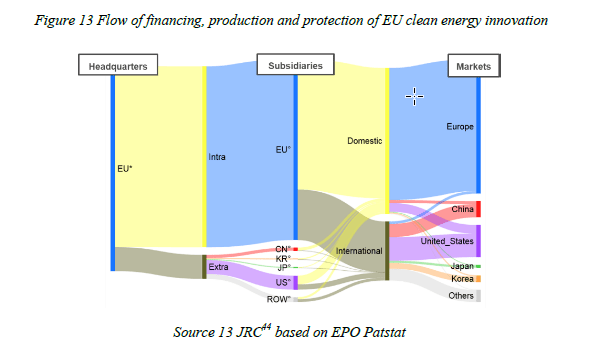

The majority of inventions from multinational firms headquartered in the EU are produced in Europe and, for the most part, with subsidiaries located in the same country. Incentives, language & geographical proximity, explain major exceptions. Disruptions in the EU industry (e.g. in funding or personnel) will be the ones most affecting inventive capacity. Existing funding patterns could inform corporate R&I incentives and support measures.

One in five clean energy inventors in the EU are patenting for a company not headquartered in their country of origin. Even though, in around half of these cases both inventor and

company are within the EU, this is the highest share among major economies. While this displays the EU’s strength as an attractive destination for highly skilled personnel, mobility restrictions and personal responses to the pandemic could affect the availability of skills and the research output.

| Figure 13 Flow offinancing, production and protection of EU clean energy innovation

Source 13 JRC44 based on EPO Patstat |

The EU27 contributed 17% of scientific articles related to the low-carbon energy sector48,49 published in 2019. Publications per GDP have only marginally increased for the EU27 between 2015 and 2019, in contrast to the global trend of a 6% annual increase driven by countries such as China, Brazil and India. The EU27 specialisation in clean energy has been decreasing between 2015 and 2019[48] [49] [50], specialising instead in fields such as psychology and cognitive sciences, economics and business, and clinical medicine, at the expense of e.g. information and communication technologies, and engineering where much of clean energy research would come from. However, the EU27 did show specialisation in the areas of new materials & technologies for buildings, and in energy efficiency in industry. In terms of impact, the EU27 is slightly below the world average in terms of highly cited publications overall. However, it has a substantially better impact in the fields of new technologies & services for consumers, new materials and technologies for buildings, and nuclear safety. The EU27 scores above the world average in international scientific collaborations, and has a high share of open access publications (41% compared to a 29% world average). In contrast, other large economies collaborate much less proportionally, and tend to publish less through open access. Collaboration between public and private actors has been increasing and accounts for 14% of publications for the EU27, a score above the world average.

- Introduction – Energy system trajectories to the time horizons 2030 and 2050

The European Green Deal aims at transforming the European economy by decoupling the growth and the use of resources, and reaching carbon neutrality by 2050[51]. This context requires a new focus on the relationship between research and innovation activities and technologies’ competitiveness which will enable to reach the EU Green Deal objectives. The better understanding of the role of technology evolution, within the transition period, allows to identify potential technology gaps and resource constraints. Energy scenarios, projecting the trajectories that energy systems will possibly take to the relevant time horizons, represent a very useful instrument to reason on these themes and inform policy choices.

A recent study analyses a number of selected energy scenarios, modelling the energy system to the time horizons 2030 and 2050[52]. The scenarios selected in the study are the following:

- European Commission – Long-Term Strategy 1.5 °C scenario (EC LTS 1.5TECH), as a technology-oriented decarbonisation scenario, which leads to carbon- neutrality by 2050. This scenario reaches net-zero GHG emissions also through the development of negative emission technologies and includes development of carbon-neutral hydrogen and hydrocarbons based on a zero or negative emissions power system.

- European Commission – Long-Term Strategy 1.5°C scenario (EC LTS 1.5LIFE), based on lifestyle changes, also leads to carbon-neutrality by 2050.

- The IEA WEO Sustainable Development Scenario (IEA WEO SDS), which in addition to tackling climate change, addresses other energy-related Sustainable Development Goals (SDG).

- JRC Global Energy and Climate Outlook (GECO) 2 °C medium scenario (JRC GECO 2C_M), which is based on a global GHG trajectory for keeping global temperature rise below 2°C by 2100. v) IRENA Global Energy Transformation, Transforming Energy Scenario (IRENA GRO TES), is IRENA’s main decarbonisation scenario, based largely on renewable energy sources and steadily improving energy efficiency, to keep the rise in global temperatures to well below 2 oC by 2100. IRENA GRO TES leads to the lowest reduction in emissions across all scenarios, and is the most ambitious global reduction scenario providing detailed results for the EU, very useful for this comparison. vi) BNEF New Energy Outlook (BNEF NEO) focuses on the power sector only and partly on the demand side. The regional scope is Europe (EU28, Iceland, Norway, and Switzerland). The BNEF NEO scenario is interesting because it bases the projection of high shares of renewable energy supply on the competitiveness of renewable energy technologies rather than on a policy push.

- Greenpeace’s Energy Revolution scenario (GP ER), developed in 2015, pursues a target of reducing global CO2 from energy use down to around 4 GtCO2 by 2050, to limit the increase in global temperature under 2°C. The scenario also includes the objective of phasing-out nuclear energy.

It is remarked that the above scenarios have differences in their scope, which makes their direct comparison not always legible on one indicator or another. For example, GP ER regional scope is Europe as defined by OECD, and as such different from EU, BNEF NEO covers mainly the power sector and is not a climate change scenario, or e.g. IRENA GRO TES leads to the lowest reduction in emissions across all scenarios, and is the most ambitious reduction scenario after the EC LTS scenarios. Recognising these differences, it was opted to compare studies leading to ambitious decarbonisation but different storylines to derive commonalities and differences.

The European Commission has analysed the Long-Term Strategy scenarios in the new context of the EU Green Deal and the accelerated emission reduction ambitions for 2030 (i.e. minus 50-55%)[53]. New scenarios, derived from the EC LTS 1.5TECH scenario have been constructed, updating the assumptions and minor modelling[54]. While the updates cause changes to the shorter-term projections up to 2030, due to the changed assumption on the 2030 accelerated emission reduction, the technological options for the longer term remain unchanged. The updated scenarios may show the requirement of an earlier uptake of technologies in order to meet the higher 2030 ambitions, remarking the urgency of the adequate technological adoption.

The discussion on the results of these different scenarios is useful to derive common ideas and guidance regarding key technologies and policies to underpin the Competitiveness Progress Report.

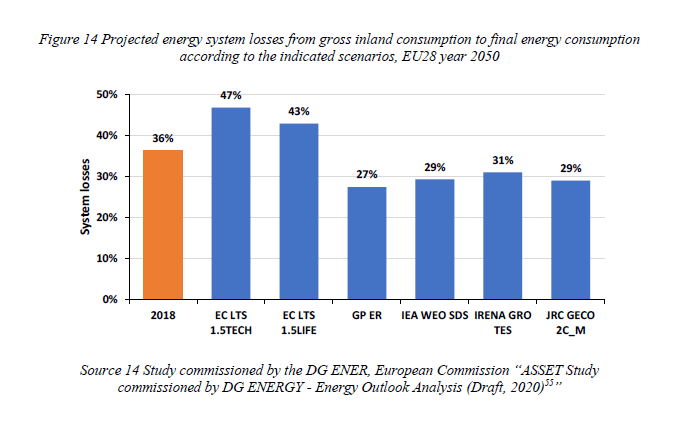

| Figure 14 Projected energy system losses from gross inland consumption to final energy consumption according to the indicated scenarios, EU28 year 2050

2018 EC LTS EC LTS GP ER IEA WEO SDS IRENA GRO JRC GECO 1.5TECH 1.5LIFE TES 2C_M |

Source 14 Study commissioned by the DG ENER, European Commission “ASSET Study

commissioned by DG ENERGY – Energy Outlook Analysis (Draft, 2020)[55]”

The scenarios, in spite of their significant differences, show a similar trend in the medium- term which points to a reduction of primary energy demand. The outlooks project a range of EU28 gross inland consumption from 1300 Mtoe to 1400 Mtoe in 2030. For the time horizon 2050, the range of the projections is wider, going from 980 Mtoe to 1475 Mtoe (in 2018, the EU gross inland consumption was 1664 Mtoe). The wider consumptions range in 2050 is associated with the EC LTS scenarios achieving carbon neutrality, which includes the use of hydrogen and synthetic fuels. Energy system losses are lower than today in scenarios that include high amounts of renewables in power generation and high electrification in final demand and no or limited amount of hydrogen and synthetic fuels. Scenarios that involve production of hydrogen and synthetic fuels from electricity increase the system losses, due to the additional energy conversion steps in electrolysis and e-fuel processes. The EC LTS (1.5 TECH and LIFE) scenarios project that hydrogen and e-fuels will be required in the system in order to be able to achieve carbon neutrality. This reduces the overall system efficiency increasing the gross inland consumption (Figure 14). The other scenarios such as IEA WEO SDS and IRENA GRO TES continue to consume fossil fuels and do not achieve climate neutrality. These scenarios have higher system efficiency but also remaining emissions in 2050.

Although the wide variation in gross inland consumption, the scenarios project final energy consumptions located in a narrower range, from 630 Mtoe to 780 Mtoe, in 2050. This also means that the reduction of the final energy demand, in all sectors, represents a key driver to achieve the emission reduction target. The gross electricity generation in the EU was about 3270 TWh in 2018, 33% produced from renewable sources. All selected scenarios project a considerable increase in electricity generation already in 2030, and a much higher increase by 2050. This growth is primarily due to direct electrification of demand sectors (especially the

electrification of private passenger road transport and highly efficient heating by heat pumps). Moreover, also the production of hydrogen and synthetic hydrocarbons through electrolysis, which is projected in some scenarios, further increases the demand for electricity. According to the scenarios, the size of the power sector expands to at least 20% by 2030-2040, and up to 70% by 2050, compared to current size.

Another common element resulting from the scenarios is the deployment of hydrogen and e- fuels in the energy sector, which ranges from 6% to 23% in 2050, while such consumption is currently negligible. To note that the two EC LTS scenarios, achieving net-zero emissions in 2050, project that electrification, primarily in the Light Duty Vehicles segment, hydrogen and e-fuels, along technology improvements, behavioural changes and coordinated investments in infrastructure along high shares of hydrogen and e-fuels of the range. As previously stated, the use of electricity to hydrogen and e-fuels may increase the total system conversion losses, compared to today. It is worth to note that the deployment of hydrogen and e-fuels in the energy sector by the time horizon 2050 is also reported elsewhere[56].

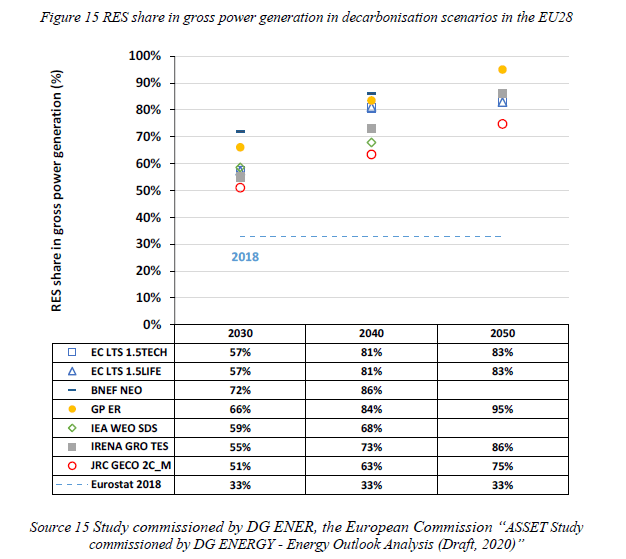

Figure 15 RES share in gross power generation in decarbonisation scenarios in the EU28

Source 15 Study commissioned by DG ENER, the European Commission “ASSET Study

commissioned by DG ENERGY – Energy Outlook Analysis (Draft, 2020) ”

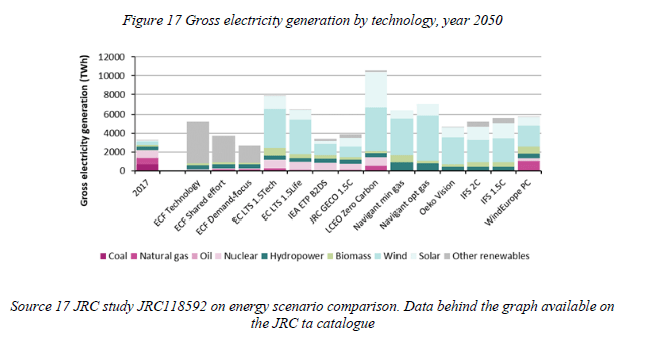

All scenarios project a similar increase in the share of RES in power generation. This ranges from 51% to 66% in 2030 and from 75% to 95% in 2050 (Figure 15), compared to about 33% today. BNEF NEO represents the upper bound with RES power supply reaching high shares earlier in the time horizon. It is already 72% in 2030 and 86% by 2040, driven by the faster cost reduction in renewable power supply technologies compared to other scenarios. The increase in generation from renewables is based on the significant increase in power production from wind and solar. Comparably, hydropower and bioelectricity only increase slightly from today’s levels over the projection horizon.

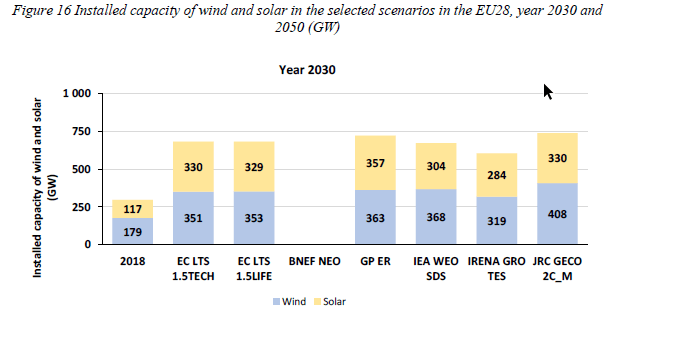

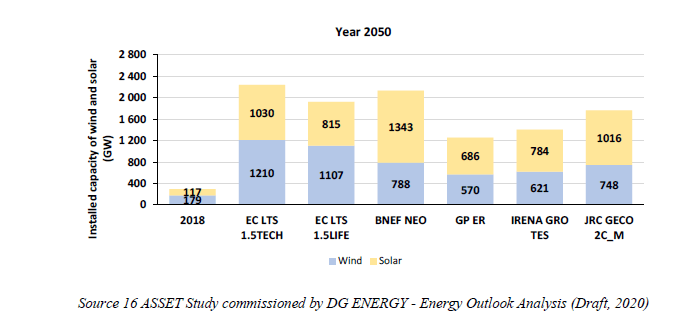

The deployment until 2030 is comparable across the scenarios. Differences emerge mainly after the year 2040, again linked with the production of hydrogen and synthetic fuels Figure 16).

Figure 16 Installed capacity of wind and solar in the selected scenarios in the EU28, year 2030 and

2050 (GW)

Year 2030

Year 2050

All the scenarios project a continuous and remarkable expansion of both wind and solar deployment, although at different absolute levels. For instance, the deployment of wind and

Source 16 ASSET Study commissioned by DG ENERGY – Energy Outlook Analysis (Draft, 2020)

solar in 2050 in EC LTS 1.5TECH reaches 2240 GW while in IRENA GRO TES it is 1405 GW. The relevant differences in the absolute capacity levels projected by the scenarios is not evident observing the share of penetration of renewables (Figure 17). However, this should be more clear recalling that the outlooks project also range of gross inland consumption quite different in size, especially at the time horizon 2050.

There are several interesting implications coming from the projected expanded deployment of wind and solar. The first is that with high absolute deployment levels within the EU (e.g. in the EC LTS 1.5TECH scenario), the EU industry may count on a strong internal market. Lower deployment levels (e.g. as in the IRENA GET TES scenario), instead, suggest that to maintain and expand its competitive position, the EU wind and solar industry need to exploit and develop also extra-EU markets given their projected large size. For instance, it has been reported that photovoltaic production in Europe and Germany across the entire value chain would be competitive, against a fab in China, if the production fab in Europe has the appropriate size. According to the study, an annual manufacturing production capacity of at least 5 GW is required[57].

A second implication is that the high deployment levels of renewables require that the network and infrastructure develop at the same pace to support the transition of the power supply system[58]. It can be envisaged that communication and control systems as well as protocols and architectures to integrate PV and wind in the smart grid will be in high demand. Similarly, high shares of variable renewable energy imply high demand for storage and system flexibility[59]. Finally, to support the deployment of such volumes of wind and solar, a broad range of skills will need to be developed, in terms of skill types and size of the workforce, in a timely manner.

As stated above, a significant part of the increase in electricity consumption derives from the road transport sector. In the selected scenarios, systems based on direct renewable use (biofuels) and EV deployment are the main decarbonisation option for the transport sector. The buildings sector sees its demand rather constant to 2030, which entails efforts on energy efficiency and renovation. Electricity consumption in buildings increases significantly post- 2030, with heat pumps being a key technology deployed widely across the scenarios Industry is a very diverse sector, which needs detailed analysis on a process-by-process level to carefully evaluate the decarbonisation options (electrification, energy efficiency, fuel switching). The level of detail of coverage of the industrial sectors varies significantly across the scenarios. The sector’s demand for electricity increases because of expansion of the large- scale industrial heat pumps and further use of electrical motors. However, there are hard-to- electrify functions in the industry, due to chemical processes and the temperatures required (although high temperature heat pumps are being developed). The scenarios show that fuel switching to biomass and hydrogen/e-gas will be used to further reduce emissions. To note that industry is the main source for process related CO2 emissions, not directly related to combustion, but to chemical processes within industry (iron and steel production, cement industry and chemical sector).

Another recent study60 presents a comparison of eight scenarios achieving more than 50% reduction of greenhouse gas emissions by 2030 compared to 1990, and sixteen scenarios aiming at climate neutrality by 2050.

The comparisons shows specific elements charactering the energy system in terms of uptake of clean and low carbon energy technologies, for the period up to 2030. First in the period it is projected a growth of wind and solar power generation (a factor from 1.5 to 3.5 for wind and from 1.5 to 4.5 for solar). A second emerging element is the replacement of the fossil heating mainly by heat pumps and district heating in 10% to 35% of the buildings. In the transport sector, it is projected an uptake of a vehicle stock that consists of 30% to 50% of zero-emission or plug-in hybrid EV. At the time horizon 2050, the scenarios project an undisputed growth of wind and solar, varying between a factor 3 and 13, heavily linked to the level of hydrogen/e-fuel production. In 2050, the consumption of electricity for hydrogen production can reach up to 3 600 TWh which is comparable to the current size of the sector. At the same time horizon 2050, the scenarios project a level of carbon removal that can reach up to 260 MtCO2 per year, of which around 200 MtCO2 through direct air capture or almost entirely through Bio-energy with carbon capture and storage (BECCS). Finally, it is projected an uptake of 65% to 90% zero emission vehicles and a passenger Battery EV fleet numbering between 100 and 220 million.

| Figure 17 Gross electricity generation by technology, year 2050

Source 17 JRC study JRC118592 on energy scenario comparison. Data behind the graph available on the JRC ta catalogue |

- Offshore renewables – Wind

During the last decade, the focus in the wind sector shifted towards offshore wind technologies due to higher capacity factors achievable, much larger sites availability and a remarkable cost reduction, supported by important technological advances, such as in wind [60] turbine reliability. Also, offshore could build on some lessons learned in the onshore wind sector and competitive tendering. Offshore wind is expected to play a significant role in reaching Europe’s carbon-neutrality target, with an estimated installed capacity need between 240 and 450 GW by 2050. By that time, 30% of the future electricity demand will be supplied by offshore wind. Starting as a first mover in the offshore sector, with the first offshore wind farm installed in Denmark in 1991, the EU currently is a global leader in offshore wind manufacturing[61].

3.2.1. State of play of the selected technology and outlook Capacity installed, generation

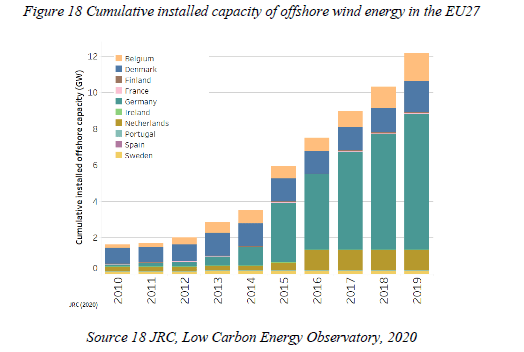

| Figure 18 Cumulative installed capacity of offshore wind energy in the EU27

Source 18 JRC, Low Carbon Energy Observatory, 2020 |

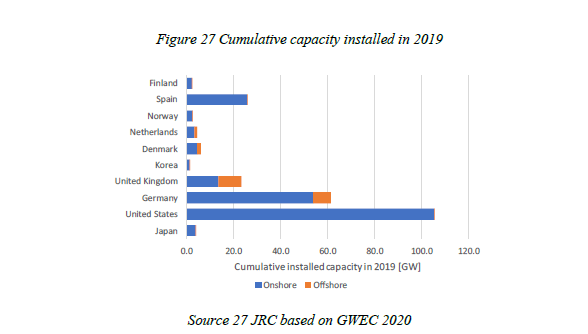

By the end of 2019, the global offshore wind capacity installed was 29.1 GW[62], representing 0.3% of global electricity generation[63]. Of this 29.1 GW, 75.1% is located in Europe (21.9 GW in EU28; 12.2 in EU27), 7.2 GW in Asia and 0.03 GW in North America[64]. In 2019, a record of 6.2 GW new offshore wind was installed globally, of which 3.6 GW in EU28 and 1.8 GW EU27[65].

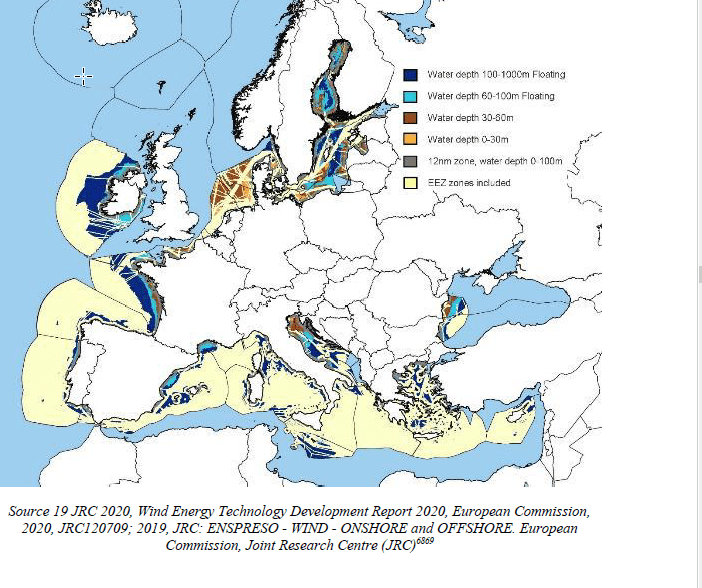

Social opposition against onshore wind energy, high setback distances to settlements and depletion of onshore wind sites with the best wind resources in selected countries might accelerate the uptake of the offshore wind sector. Against this backdrop, offshore renewable energies offer an opportunity for sustained growth to EU Member States. Analysing the JRC ENSPRESO dataset[66] per sea basin shows that technical potentials for offshore wind in EU27

EEZ[67] [68] zones are highest in the Atlantic Ocean (1 447 GW) followed by the Mediterranean Sea (1 445 GW), Baltic Sea (1 183 GW), North Sea (437 GW) and the Black Sea (160 GW) (Figure 18). Areas with sea depths necessitating the deployment of floating offshore wind are vast (2 468 GW) and promising for countries with steeper coastlines (Atlantic Ocean (1 066 GW) and Mediterranean Sea (819 GW)). The floating offshore potential of the EU27 in the North Sea is limited to 30 GW. Still the North Sea (284 GW) and the Baltic Sea (225 GW) offer most of the technical potential for projects in shallower waters (up to 60m depth and outside the 12 nautical miles zone).

| Figure 19 JRC ENSPRESO technical potentials for offshore wind in sea basins accessible to EU27

countries

|

Source 19 JRC 2020, Wind Energy Technology Development Report 2020, European Commission,

2020, JRC120709; 2019, JRC: ENSPRESO – WIND – ONSHORE and OFFSHORE. European

Commission, Joint Research Centre (JRC)6869

According to the LTS, 80% of electricity should come from renewable energy sources by 2050. The EU LTS full decarbonisation scenarios (1.5 TECH and 1.5 LIFE) see offshore wind ranging from 390 – 451 GW (EU28). Notably, scenario results on offshore wind show a strong connection on a country’s exploitation of its onshore wind potentials70,71.

Global estimates see offshore wind capacity at about 234 GW by 2030, of which 6.2 GW will use floating offshore technology. Global long term estimates range from 562 GW in 20 40[69] [70] [71] [72] by the IEA SDS scenario to up to 1 400 GW in 2050 by the industry-led Ocean Renewable Energy Action Coalition (OREAC)[73] [74] [75] [76] [77].

Other technology outlooks striving for deep carbonisation at EU level (aiming for only the 2°C temperature increase target, instead of 1.5°C) report a wide range of future wind energy deployment depending on the overall transformation of the EU energy system. By 2050, these studies show a wind capacity (both onshore and offshore) in the EU between 465 GW and 1 700 GW generating 1 200 TWh to 4 800 TWh. This would translate into 28% to 68% of the European electricity needs74,75.

Cost, LCOE

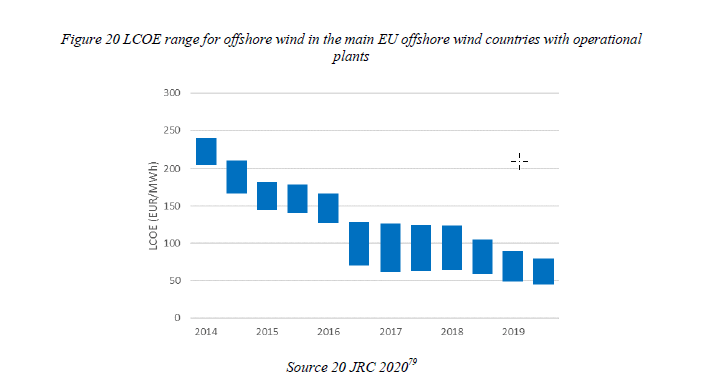

Costs decreased from over EUR 200/MWh in 2014 to a range of 45-79 EUR/MWh at the end of 2019, based on country data from Belgium, Denmark, Germany, the Netherlands and the United Kingdom76,77. The turbine represents up to 45% of total installed costs[78] (other cost factors include the foundations, the grid connection to shore and the installation). The cost of offshore wind installations is therewith reaching the one of onshore installations.

| Figure 20 LCOE range for offshore wind in the main EU offshore wind countries with operational

plants

Source 20 JRC 202079 |

Drivers for this cost decline are the upscaling of turbine size, projects size (economies of scale), weight reduction due to innovative materials (benefitting from about EUR 76 million in the period 2009-2019 stemming from FP7 and H2020 wind related projects – Figure 20) and favourable financing.

Offshore wind turbines have been growing in size and rated power capacity, with a capacity increase of 70% between 2015 and 2018 (from 3,7 MW to 6.3 MW) in the EU[79] [80]. Recent offshore wind projects have observed capacity factors of up to 40-50%. The upscaling of rated capacity (e.g. towards > 10 MW) of the single wind turbines allows to deploy fewer turbines within one wind park, which means large savings on steel and foundations[81]and embedded CO2 emissions; as well as reduced flexibility demand (longer production hours). The demonstration of a new offshore wind turbine 12 MW GE Haliade-X Maasvlakte with an expected capacity factor above 60% is under way in the Netherlands, with a planned commercial exploitation as of 2021[82]. SGRE is testing its 10.0MW model in Denmark. Potential upgrades to rated capacities of 14 MW and 11 MW are announced for both turbines from GE and SGRE, respectively[83] [84] [85]. The largest commercial turbine is the MHI Vestas V164 with a rated capacity of 9.5 MW. It is expected that this turbine will be commissioned in

offshore projects until 202284,85.

CAPEX for offshore wind projects are declining rapidly and depend on the rated turbine capacity, depth of the site (and the foundation technology pursued) and the size of a project. IEA estimates CAPEX in 2018 of EU projects averaging around 3400 EUR/kW86,87.

In the run up to 2050, decrease in estimated CAPEX for offshore wind is expected to range between 2050 EUR/kW and 2730 EUR/kW for an average offshore wind project[86] [87] [88]. This CAPEX reduction is mainly driven by the increase in average turbine sizes (e.g. from about 4 MW in 2016 and 8 MW in 2022 to about 12-15 MW in 2025) and the increase in offshore wind project size resulting in scaling effects[89].

Operation & maintenance costs[90] (O&M) are also decreasing. Global average annual O&M costs for offshore wind were about USD 90[91]/kW in 2018, and are projected to go down by one-third by 2030 and further decline towards USD 50[92]/kW in 2040 (a decrease of 40% compared to 2018). These reductions will be mainly due to economies of scale, industry synergies, along with digitalisation and technology development, including optimised maintenance concepts [93].

R&I

R&I in offshore wind revolves mainly around increased turbine size, floating applications (particularly substructure design), infrastructure developments and digitalisation.

In 2018 the EC-funded SET plan Implementation Working Group (IWG) for Offshore Wind developed specific targets and R&I priority actions to maintain European leadership in offshore wind (to be revised in November 2020 following the adoption of the offshore renewables strategy). The SET plan mentions two priority actions: (1) Reduce the LCOE at final investment decision (FID) for fixed offshore wind by improvement of the performance of the entire value chain striving towards zero subsidy cost level for EU on the long term; (2) Develop cost competitive integrated wind energy systems including substructures which can be used in the deeper waters (>50 m) at a maximum distance of 50 km from shore with an LCOE of <12ct EUR/kWh by 2025 and < 9ct EUR/kWh by 2030.

Cost reduction through increased performance and reliability, development of floating substructures for deeper waters and the added value of offshore wind energy (system value of wind) were pivotal elements of the SET plan Implementation Plan (IP). In order to achieve this targets, the IP proposes to focus R&I activities on system integration, offshore wind energy – Balance of Plant, floating offshore wind, wind energy O&M, wind energy industrialisation, wind turbine technology, basic wind energy sciences, ecosystem and social impact and the human capital agenda. The IWG estimated that projects addressing these priorities need a combined investment of EUR 1090 million until 2030 with a split in contributions of Member States 34%, EU 25% and Industry 41%.

Apart from EC-funded projects, the IWG reported in 2019 a significant number of nationally funded projects (17 out of 24, with single project budgets up to EUR 35 million) with a main focus on the R&I priorities ‘Wind Energy Offshore Balance of Plant’, ‘Floating Offshore Wind’ and ‘Wind Turbine Technology’94,95. Other joint industry programmes not covered so far within the SET-Plan include projects from the Dutch GROW programme, the UK Offshore Wind Accelerator programme, the Offshore Renewables Joint Industry Programme (ORJIP Offshore Wind) (UK), the Floating Wind Joint Industry Project (Floating Wind JIP) (UK) and DNV GL’s Joint Industry Projects (JIP) on Wind Energy. An update of the IP is envisaged until the end of 2020 and aiming for incorporating and further developing the R&I priorities identified by the main research and industry bodies (ETIP Wind 2019, EERA 2019 strategy, IEA TCP Grand Challenges)[94] [95] [96].

This is in line with the EC strategic planning towards the Horizon Europe research and innovation programme, which stresses the importance of achieving global leadership in affordable, secure and sustainable renewable energy technologies[97].

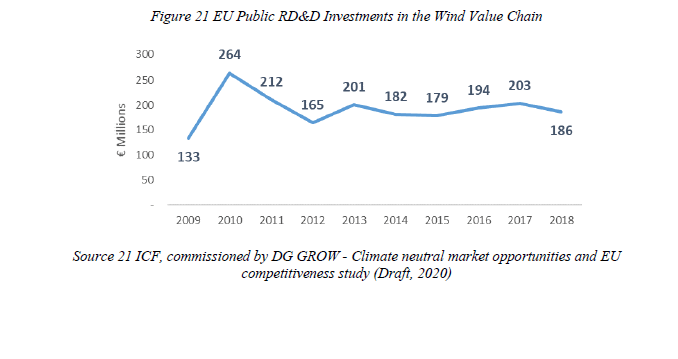

| Figure 21 EU Public RD&D Investments in the Wind Value Chain

Source 21ICF, commissioned by DG GROW – Climate neutral market opportunities and EU competitiveness study (Draft, 2020) |

Source 22ICF, commissioned by DG GROW – Climate neutral market opportunities and EU competitiveness study (Draft, 2020) |

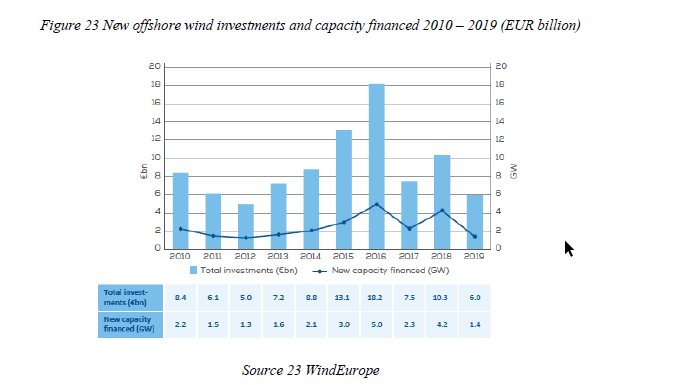

Overall Investments

Innovators in the overall wind value chain have managed to attract considerable levels of early stage and late stage investments. However, the vast majority of early stage and late stage investments in the wind energy sector were made outside of Europe with the US and India benefiting from large investment volume. Only for wind rotors, 69% of the total amount of early investments and 63% of late stage private investments occurred in the EU[98] [99] [100].

Commercial banks have increased their financing of offshore wind projects, helped by the stable policy frameworks in some countries and the participation of public finance institutions such as the EIB. Also, competitive tender schemes and EC State Aid Guidelines play a role in investment: the shift from feed-in-tariffs to tender-based support schemes promoted by the EEAG has resulted in highly competitive price bidding from mid-2016 onwards. So far, more than 3.1 GW of offshore capacities have been allocated under zero-subsidy bids in Germany and the Netherlands, and bid prices have decreased in tenders held in Denmark and in the United Kingdom. Across all EU countries a cumulative offshore wind capacity of about 13 GW has been allocated through competitive tendering procedures, which are expected to be commissioned until 202599,100. Given the small number of large wind farms that reach final investment decision each year and the heterogeneity of the national investment frameworks, investment figures can be volatile year on year.

Globally, investment in offshore wind would need to grow substantially over the next three

decades, with overall cumulative investment of over USD 2750 billion101 from now until

2050. Annually, average investment would need to increase more than three-fold from now

until 2030 and five-fold until 2050. Major investments are required for rapid installation of

new OW power capacities102.

As mentioned in section 3.1, an assessment of modelling works show that offshore wind is

important in decarbonisation scenarios.

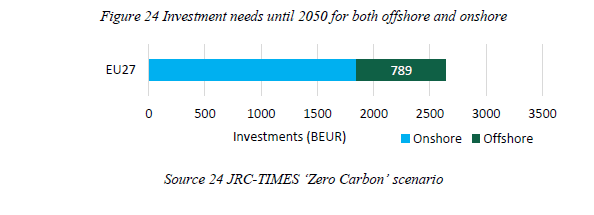

According to the JRC-TIMES ‘Zero Carbon’ scenario, investment in wind energy clearly

dominates among the different low carbon energy technologies with about EUR 3 170 billion

until 2050 of which EUR 995 billion are deployed offshore (EUR 789 billion excluding the

UK).

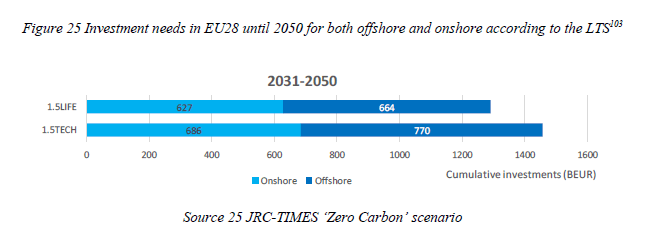

According to the main LTS decarbonisation scenarios, cumulative investments in offshore

wind range between EUR 660 and EUR 770 B from 2030 onwards.

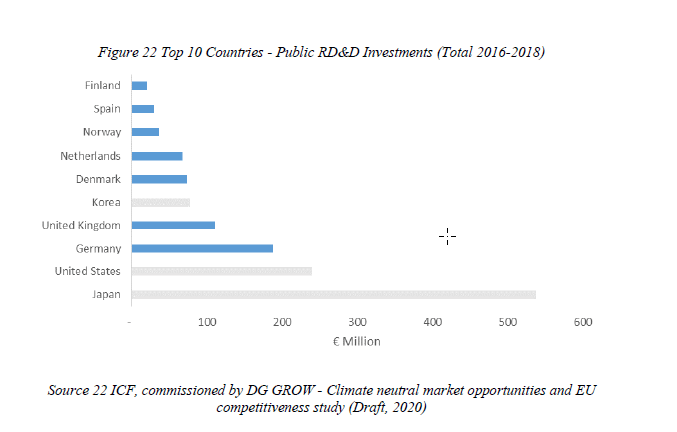

Public R&I funding

EU public R&D investments have grown from EUR 133 million in 2009 to EUR 186 million

in 2018). Comparing the last three years of EU public R&D spending with its global

competitors only Japan shows similar numbers.

As illustrated above, R&D funding in wind energy has been growing considerably in Japan

over the last decade with strong governmental support to the Japanese floating wind energy

industry104. However, when plotting investments in R&I vs deployment, it appears that

biggest capacity installed in the US, followed by EU.

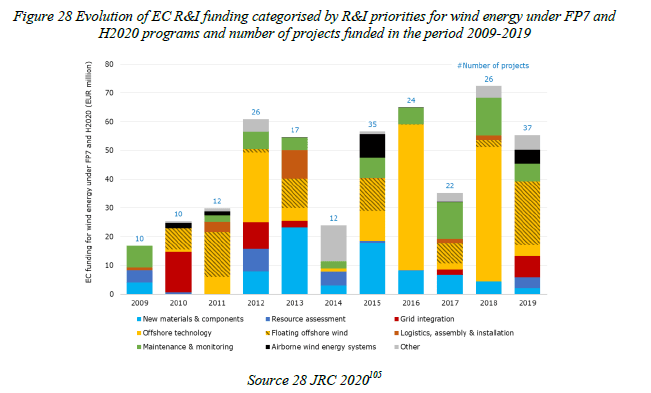

At the EU level, the R&I priorities include all aspects aimed to provide secure, cost-effective, clean and competitive energy supply, such as new turbine materials and components, resource assessment, grid integration, offshore technology, floating offshore wind, logistics, assembly, testing and installation, maintenance and condition-monitoring systems and airborne wind energy systems, among others (see Figure 28).

Source 28 JRC 2020[105]

In the period 2009 – 2019, Horizon 2020 and its predecessor FP7 have granted funds of about EUR 496 million to these aspects, putting the strongest emphasis in terms of funds on research in offshore technology (EUR 150 million) followed by floating offshore wind, new materials & components and maintenance & monitoring.

Private R&I funding

In general, in Europe around 90% of the R&I funding in (onshore and offshore) wind energy comes from the private sector[106]. R&I investments in Europe are highly concentrated in Germany, Denmark and Spain, accounting for 77% and 69% of EU corporate and total R&D funding respectively[107].

Private investment into wind rotors is responsible for 1% of total investment in wind in RoW markets but ~ 20% in European markets over the 5-year period[108].

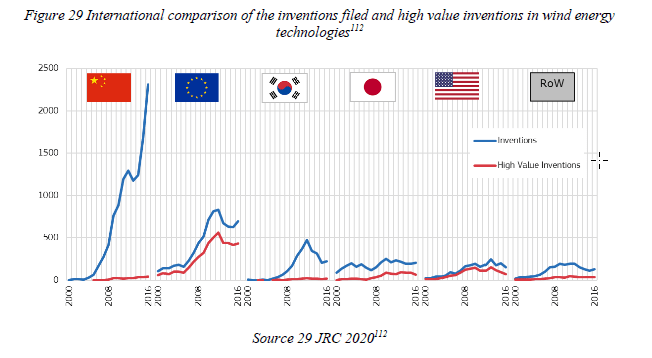

Patenting trends[109]

Europe has the highest specialisation index (indicating the patenting intensity) in wind energy compared to the rest of the world[110]. The EU wind rotors accounted for 67% of the high value patent application between 2014 and 2016[111] [112] (see Figure 29).

| Figure 29 International comparison of the inventions filed and high value inventions in wind energy

technologies112

Source 29 JRC 2020112 |

With its annual growth rate of 50% in 2000-2016, China ranks first in wind energy inventions after overtaking from the EU in 2009, which had been world leader since 2006110. However, Chinese patenting activity is aimed for protection in its national market. Of the more than 70% of patenting inventions filed on wind energy technologies, about 2% were high value inventions[113] (vs around 60% of high value inventions for Europe and the United States).

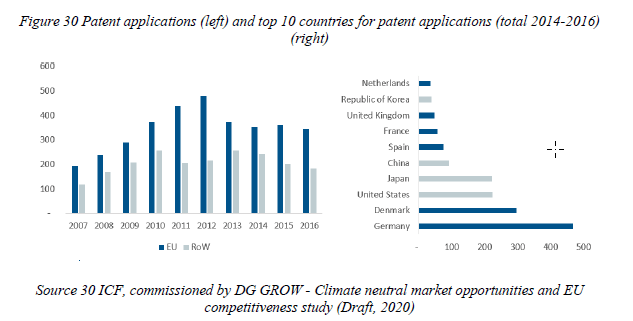

| Figure 30 Patent applications (left) and top 10 countries for patent applications (total 2014-2016)

(right)

Source 30ICF, commissioned by DG GROW – Climate neutral market opportunities and EU competitiveness study (Draft, 2020) |

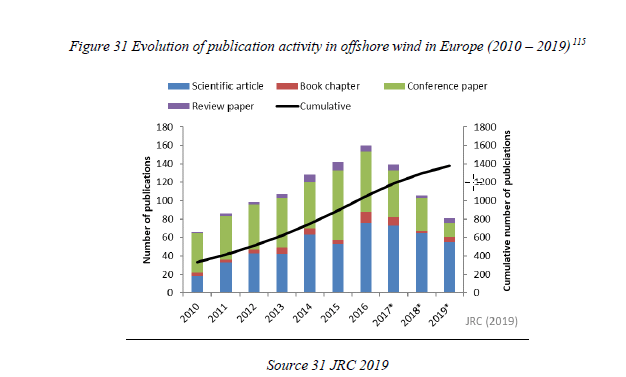

Publications / bibliometrics

The leading EU organisations in offshore wind publications in the period 2010 -2019 come from the leading countries in offshore wind deployment (Denmark, Germany, the Netherlands and the United Kingdom) but also from countries expected to be future offshore wind markets (Spain) or which are engaging in emerging offshore wind technologies such as floating offshore wind (Norway and Portugal). Research is predominantly published as conference papers or scientific articles with the latter increasing steadily their share from about 27% in 2010 to 48% in 2016, which might be an indication that offshore wind research matured (Figure 31). Yet preferred collaborations between organisations seem to be affected by geographical or historical reasons as they can build already on a strong national cooperation. Among others a focus on research in monopiles, steel constructions and grouted joints, numerical modelling and dynamic analysis of floating offshore wind turbines can be identified from bibliometrics. Co-publication activity among the different research organisations is found to be rather limited indicating that there is an untapped potential for cross-border research collaboration[114].

Source 31 JRC 2019

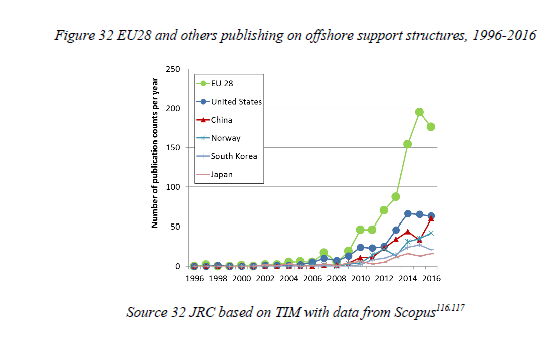

Comparing publication activity on a global level unveils that EU is leading in publishing activity in the area of wind turbine blades and offshore support structures, followed by the United States and China (see Figure 32) [115] [116] [117]

| Figure 32 EU28 and others publishing on offshore support structures, 1996-2016

Source 32 JRC based on TIM with data from Scopus11‘ |

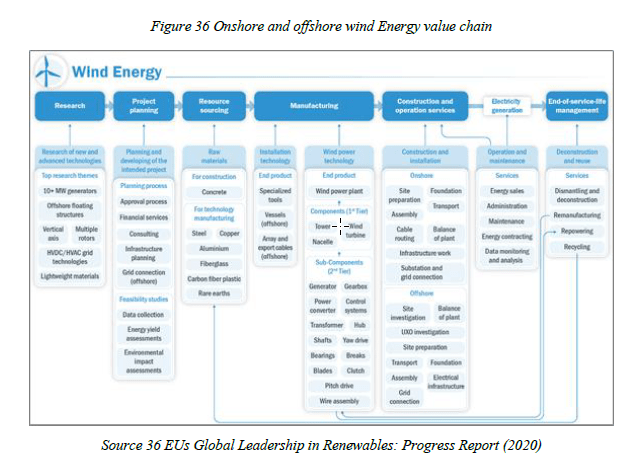

- Value chain analysis

Since the value chains of offshore and onshore wind largely overlap, this section addresses both of them. For the onshore-specific part of the value chain, please refer to Value chain analysis in the chapter on onshore wind.

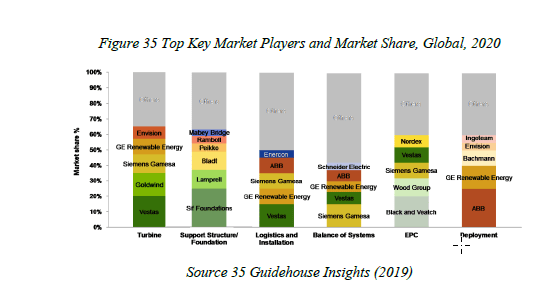

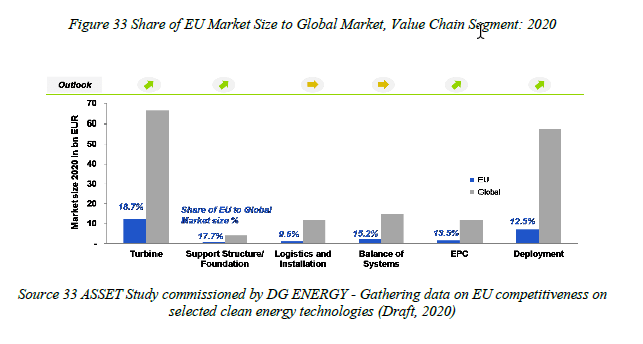

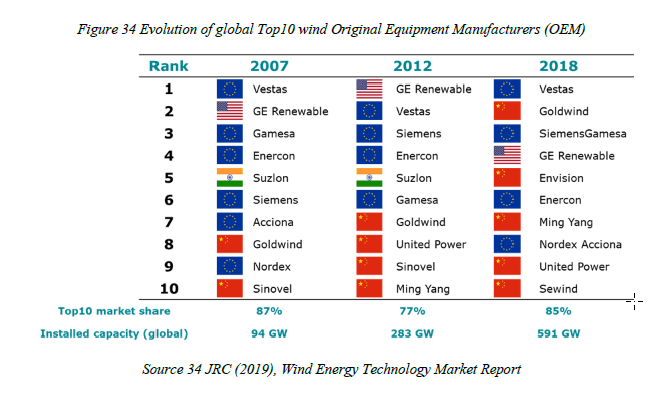

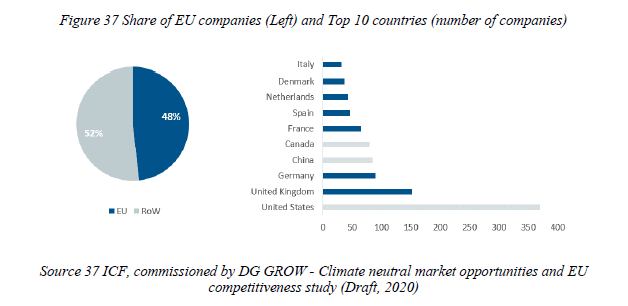

Europe is a recognized market leader in the wind energy and wind rotor sectors: 48% of active companies in the wind sector are headquartered in the EU compared to the RoW[118]. European manufacturers capture around 35% to 40% of the global wind turbine value chain (China almost 50%). The European OEMs in the wind energy sector have held a leading position in the last few years although their market share has decreased in 2018 mainly in favour of the Chinese OEMs. Within the next decade, Europe will maintain its leadership position in annual growth, yet China, Asia Pacific and North America are expected develop a significant market size (i.e. installed capacity) of more than 50%[119]. Among the top 10 OEMs in 2018, European OEMs led with 43 % of market share, followed by the Chinese (32 %) and North American (10 %) companies (see Figure 33).

The (onshore and offshore) wind energy sector is globalising, which brought an increasing number of mergers and acquisitions (M&A) over the last few years. Of the 58 M&A since 2010, 26 operations were between European companies[120].

Figure 33 Share of EU Market Size to Global Market, Value Chain Segment: 2020

Figure 34 Evolution of global Top10 wind Original Equipment Manufacturers (OEM)

Source 34 JRC (2019), Wind Energy Technology Market Report

|

|||

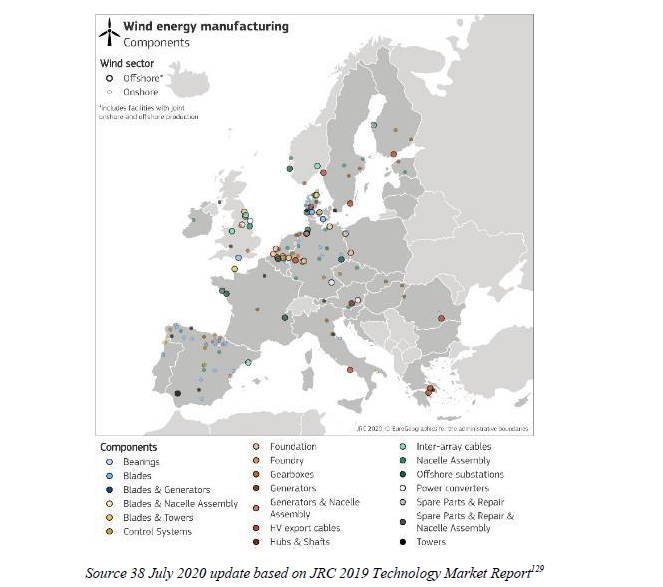

The main components of offshore wind comprise foundations; substations (transforming generated power); electric offshore wind cables; and installation vessels. Europe’s offshore wind industry is driven by a strong home market that accounts for about 91% of worldwide offshore capacity fully commissioned by mid-2016.

Components of (offshore and onshore) wind turbines are manufactured either in-house of by independent suppliers. For most critical wind turbine components, leading OEMs have inhouse manufacturing capability, except for the gearbox component, which is outsourced by almost all turbine vendors121.

Most European manufacturing facilities are located in the country of the company’s headquarter or countries with increased wind energy deployment. 48% of active companies in the wind sector are headquartered in the EU. Specifically for wind rotors, the share of EU companies is 58%, with most headquartered in Germany, Denmark and France. Europe is

leading in all parts of the value chain for sensing and monitoring systems for onshore wind turbines, including research and production[121].

OEMs also locate their manufacturing facilities in countries where they supply wind turbine components and services, except for Gamesa (ES) and Senvion SE (DE), whose manufacturing facilities are only placed in their country of origin. Smaller OEMs tend to locate their facilities around their headquarters[122].

The EU wind sector has shown its ability to innovate: the EU is leading in the parts of the value chain dealing with sensing and monitoring systems for onshore wind turbines, including research and production. Also, the EU wind industry has high manufacturing capabilities in components with a high value in wind turbine cost (towers, gearboxes and blades), as well as in components with synergies to other industrial sectors (generators, power converters and control systems).

| Figure 36 Onshore and offshore wind Energy value chain

Source 36 EUs Global Leadership in Renewables: Progress Report (2020) |

In the context of the potential impact of Covid-19 on the value chain, the forecasts for offshore wind remain unchanged[123] given that many European projects are already at a late stage of construction. Moreover, offshore wind has longer lead times than onshore wind. Many projects are expected to be commissioned from 2021/22 onwards.

Number of companies in the supply chain, incl. EU market leaders 48% of active companies in the wind sector are headquartered in the EU. 7 out of the top 10 countries where these companies are located are within the EU, with the UK and Germany standing out[124].

Figure 37 Share of EU companies (Left) and Top 10 countries (number of companies)

Figure 37 Share of EU companies (Left) and Top 10 countries (number of companies)

Source 37ICF, commissioned by DG GROW – Climate neutral market opportunities and EU

competitiveness study (Draft, 2020)

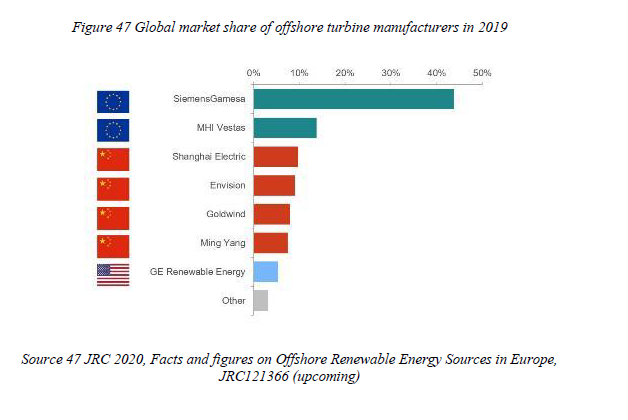

In 2019 the European market consisted of four offshore wind turbine manufacturers[125]. The squeeze on revenue streams from auctions is reflected in rapid supply-side consolidation. Siemens Gamesa Renewable Energy (SGRE) supplied 62% of all the new grid-connected capacity in the EU (which are 323 turbines in 2019). MHI Vestas Offshore wind supplied 28% in 2019; GE Renewable Energy 7%; and Senvion 3%[126] [127] [128]. European offshore wind projects coming online in the period 2020-2024 suggest that Siemens Gamesa Renewable Energy (SGRE) will maintain its leadership position (56%), yet GE Renewable Energy (26%) will surpass MHI Vestas Offshore Wind (18%) due significant deployments in the UK and Portugal127. The share of EU companies in the wind rotors sector is 58%, with most headquartered in Germany, Denmark, the UK and France128.

Monopile foundations dominate the European market (74% of total capacity installed), followed by other concepts such as tripods and jacket structures. Leading EU foundation suppliers are located in the North Sea and Baltic Sea countries. They anticipate to the ongoing trend towards next generation turbines by providing XL monopiles. With regards to the suppliers, Sif Netherlands (NL) supplied half of all foundations in 2019, followed by Lamprell (Saudi Arabia – 19%), Navantia-Windar Consortium (ES – 11%), Bladt Industries (DK – 10%) and EEW Group (DE – 9%). Since 2015 the European market is led by EEW Group and Sif Netherlands. Other European companies capable to manufacture offshore foundations include Smulders (Eiffage Group) (FR) and Steelwind Nordenham (Dillinger

Group) (DE) Due to the increased number of projects being installed in deeper waters and further away from shore, jacket foundations and gravity base foundations are becoming more popular. In addition to the aforementioned monopile suppliers (Bladt Industries, Smulders (Eiffage Group)) Navantia (ES), Lamprell (VAE) and Burntisland Fabrications Ltd (UK) have a track record in supplying jacket foundations for offshore wind projects in deeper waters.

In offshore wind, only a limited number of tower manufacturers exist, due to high technological requirements. The component is usually sourced locally, with manufacturers based in Europe’s main offshore wind markets (Denmark and Germany).

The offshore wind substations, transforming the power generated to grid voltage, mainly use High Voltage Alternating Current (HVAC) as the benefits of current High Voltage Direct Current (HVDC) technology (i.e. minimized losses) are displaced by higher costs and system complexity, such as construction of substation topsides. European manufacturers (CG Power Systems (BE), Siemens AG (DE), ABB, GE Grid Solutions (FR), Chantiers de l’Atlantique (FR), Aibel AS (NO)) lead the worldwide market of the main electrical components of HVAC and HVDC (see section on smart grids) and the design and engineering of electrical offshore substations for offshore wind farms. Shortage in supply might only come from unforeseen increased demand from other sectors. About 55 % of offshore wind substations use jacket foundations. Manufacturing of substation foundations is outsourced to the aforementioned foundation suppliers.

The demand for offshore wind cables includes array cabling connecting wind turbines, as well as export cables connecting wind parks to the shore. For both sub-technologies more than multiple European cable manufacturers supply products and have recently increased their capacities to meet EU demand. However, the last years brought a stronger concentration in the European offshore cable market (e.g. with ABB selling its cable branch to NKT or Prysmian Group acquiring NSW). European offshore cable manufacturers locate their facilities all over Europe (IT, ES, DE, EL, RO, SE, UK, NO, FI). Outside Europe, Asian suppliers from China, South Korea and Japan show capabilities in offshore wind cabling. With respect to HV export cables the European manufacturers Nexans (FR), NKT (DK) and Prysmian Group (IT) are the global market leaders. Array cabling currently undergoes a shift from 33 kV towards 66 kV cabling. Most companies (such as Prysmian Group (IT), JDR Cables (UK) or Cablel Hellenic Cables Group (EL)) seem capable to undertake this shift; however, lengthy processes towards product commercialisation might result in bottlenecks. Notably, some of the Asian manufacturers also entered other markets such as LS Cable & System (KR) providing the array cabling to the Kriegers Flak OWF (DK) and the Block Island OWF (US).

Source 38 July 2020 update based on JRC 2019 Technology Market Report129

|

The offshore wind industry uses jack-up vessels and heavy-lift vessels to install wind turbines, foundations, transition pieces and substations. The move towards wind turbines with higher capacity, longer blades, higher towers, and XL foundations capable to operate at deeper waters, resulted in a significant increase of the vessels’ weight and size, a trend that is expected to continue in the mid-term. The decisive figures of a vessel are its size and crane capacity, with the latter being currently upgraded at more and more vessels. Compared to crane capacities in 2010 of about 800 t, current crane standard capacities range between 900 t to 1 500 t. In the short term industry expects crane sizes of 1 800 t to be the norm. At the same time, the downturn of the oil industry made more vessels available for the offshore wind market, which led to disinvestments of first-generation vessels. The market for installation vessels is clearly dominated by European companies covering the broadest crane capacity range. This includes the heavy-lift vessels with the highest crane capacity Saipem 7000 (14 000 t) and Heerema’s Thialf (15 652 t). Notably, the first move of the fossil-fuel [129]

player Saipem into the offshore wind turbine installation market was at the Hywind floating offshore wind project in Scotland for Equinor. In Europe, but also globally, increased crane capabilities will especially be needed in the area of foundations, where current monopiles (ranging at about 1 200 t) are already reaching the limits of most vessels. Future XL monopiles weighing 2 000 t are already in the pipeline, and could lead to bottlenecks in vessel availability. Similarly, the installation of weighty offshore substations (foundations and topsides) requires heavy-lift vessels with significant crane capacity130129. With together more than 50% since 2010, the EU market for turbine and foundation installers is led by DEME Offshore (BE) and Van Oord (NL), yet the sector sees multiple other players with significant market share over the last years (e.g. Fred Olsen (NO), Jan de Nul (BE), Swire Blue Ocean (DK), Subsea 7 (UK), Boskalis (NL), OHT Management (NO), Saipem (IT)). Boskalis is leading the market for the installation of cables, however also major cable manufacturers are among the strongest competitors (Prysmian Group and NKT)[130] [131]. An increased future deployment of floating offshore concepts necessitates substantial investments in port infrastructure and crane capacity for lifting at the quayside as most floating offshore wind concepts will be fully assembled at the port before towed-out to the power plant site.

Source 39IEA analysis based on BNEF (2019)

Turnover

Overall, the wind energy sector generates a turnover of EUR 48 billion (2017)[132]. Turnover in the sector has grown 19% between 2015 and 2017. The Member States that generate the most are Germany, Denmark and Spain.

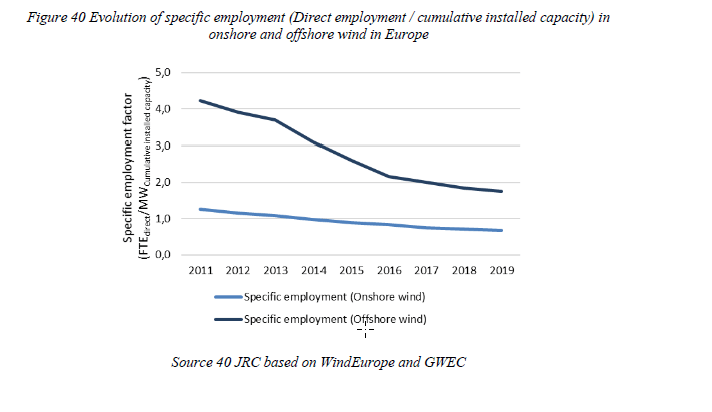

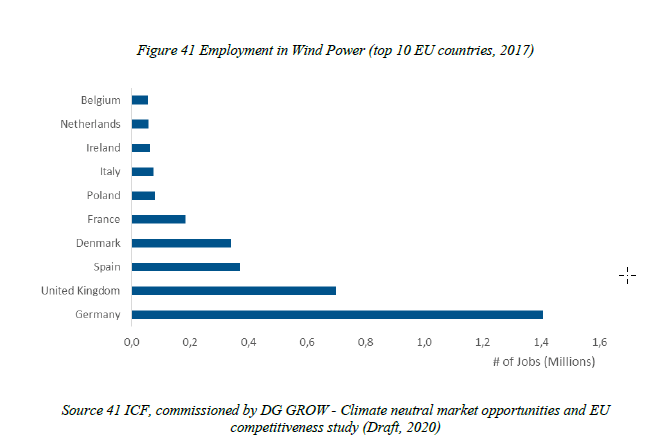

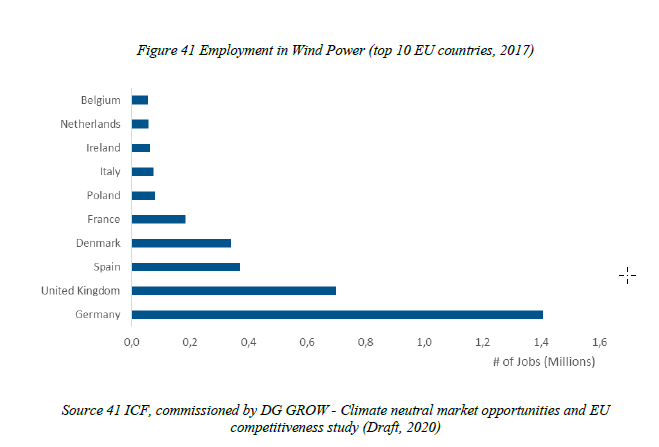

Employment figures[133]

Overall, the wind energy sector employs 357 000 Europeans directly and indirectly (2017)[134]. Employment in the sector has grown 13% between 2015 and 2017. The Member States that employ the most are Germany, Spain and Denmark[135].

The current number of jobs in the European offshore wind sector is 77 000 (38 000 direct jobs and 39 000 indirect jobs)[136]. Due to the globalisation of the wind energy sector (both onshore and offshore), the number of mergers and acquisitions increased over the last years. These transactions have consolidated the market, with wind players increasing their market share and economies of scale. Although this restructuring led to stable operating profits, the industry also witnessed significant job cuts in recent years, which were mainly limited to the onshore wind sector[137].

| Figure 40 Evolution of specific employment (Direct employment / cumulative installed capacity) in

onshore and offshore wind in Europe

|

Source 41ICF, commissioned by DG GROW – Climate neutral market opportunities and EU

competitiveness study (Draft, 2020)

Case studies estimating the workforce needed to build an offshore wind farm see employment factors declining over the latest years as the learning effect improves with more capacity installed in the sector. Direct job estimates on single projects (given in full time equivalent years) range from 16.3 – 15.8 FTE/MWproject for projects in the period 2013-2016138,139. Due to productivity improvements, some studies estimate a further decrease in specific direct labour requirements to 9.5 FTE/MWproject by 2022[138] [139] [140] [141] [142] [143] [144] [145]. Although these numbers show the expected learning effect they cannot directly be used to estimate the number of total jobs in the entire industry as the extrapolation from project-level capacity to installed capacity in the market would lead to double counting and thus an overestimation. Current econometric models estimating the number of jobs using employment factors, trade data and/or contribution to the GDP of the sectors involved shows direct and indirect figures ranging from 2.2 to 5.1

During 2009-2018, the annual production value of wind rotors in the EU remained stable between EUR 6.3 billion (2010) and EUR 10.3 billion (2016). Denmark accounts for around half of the EU production and Germany is the second largest producer. [146]

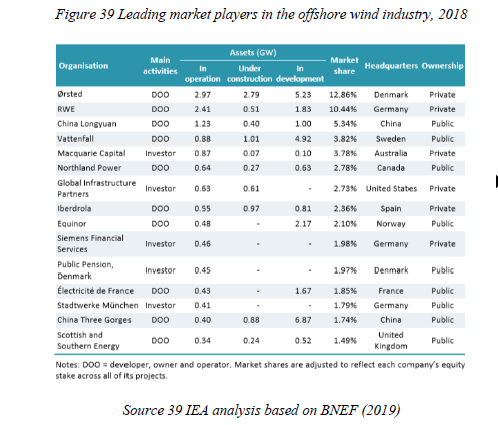

- Global market analysis

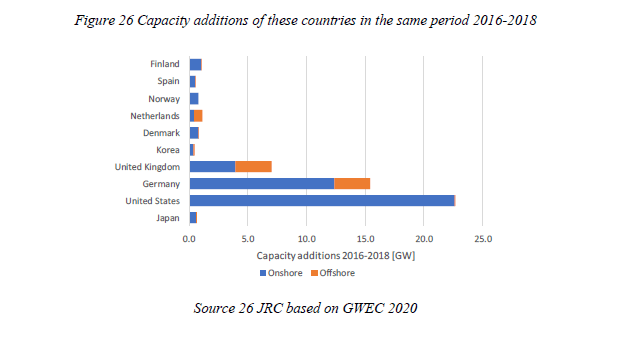

In the wind sector, Europe has both industrial and technological leadership (Europe showing manufacturing overcapacities in all key wind turbine components[147]) and strong leadership in foundations and cables industry. Even though the European offshore wind industry is competitive and represents the largest part of global installed capacity, other global players are steadily coming up.

Today, seventeen countries worldwide host offshore wind projects, with an increasing number of new non-European countries entering the market (including Japan, South Korea, Taiwan, Vietnam and the United States)[148]. Within Asia (including China), offshore wind capacity are expected to reach around 95 GW by 2030 (out of almost 233 GW projected global capacity by 2030)[149]. Nearly half of the global offshore wind investment in 2018 took place in China[150]. The total installed costs are higher in Europe than in China because Chinese deployment so far has been largely in shallow coastal waters. Offshore wind in Asia is different from Europe from a technical perspective, since the Asian industry must adapt to more challenging water depths, less robust grids, extreme weather events and increased seismic activity.

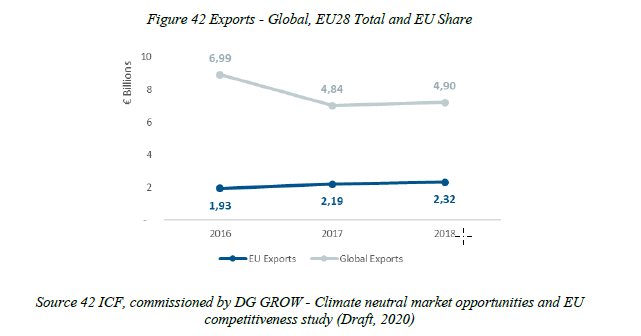

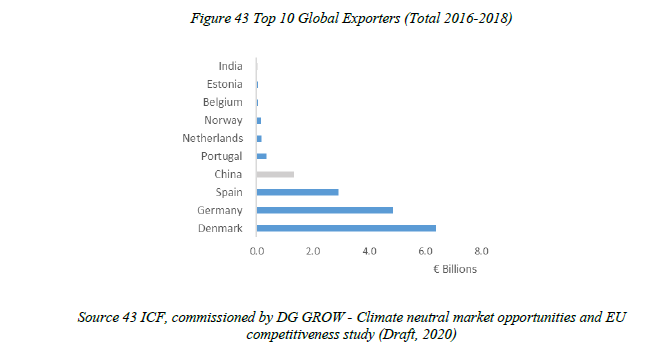

Trade (imports, exports)

Between 2009 and 2018, EU28 exports in the wind sector (both on- and offshore) to the RoW have increased steadily, reaching EUR 2.32 billion in 2018[151]. Conversely, imports have remained constant between EUR 0.03 billion and EUR 0.17 billion. The EU28 share of global exports increased from 28% in 2016 to 47% in 2018. Between 2009 and 2018, the EU28 trade balance has remained positive and with a rising trend. Between 2016 and 2018, 8 out of the top 10 global exporters were EU countries. Key RoW competitors are China and India.

competitiveness study (Draft, 2020)Source 42 ICF, commissioned by DG GROW – Climate neutral market opportunities and EU

Figure 43 Top 10 Global Exporters (Total 2016-2018)

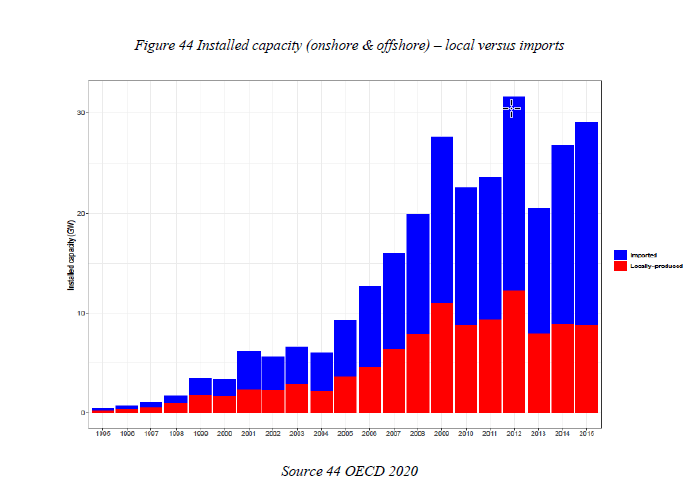

About 93% of the total offshore capacity installed in Europe in 2019 is produced locally by European manufacturers (Siemens Gamesa Renewable Energy, MHI Vestas and Senvion). A global trade analysis by OECD (2020) shows that while installed capacity of wind power is increasing globally, most of the annually added installations (global) are wind turbines made by foreign manufacturers (Figure 44). Imports of wind turbines accounted for approximately 70% of the globally added capacity in 2015[152].

| Source 44 OECD 2020 |

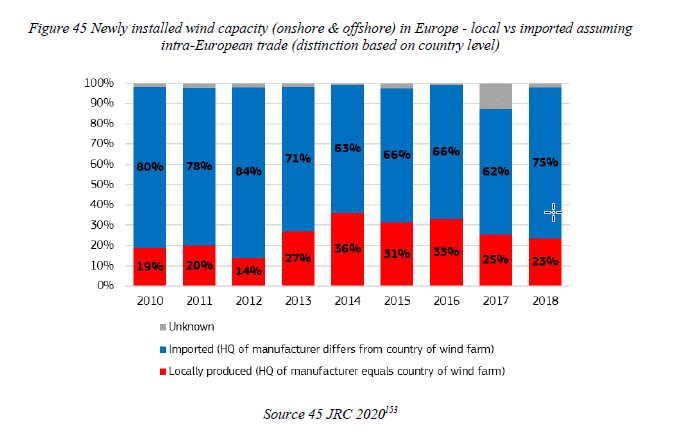

Comparing this global data with data from the JRC wind database on project location and turbine models used, unveils that similar findings on European level can only be derived when assuming intra-European trade (an export of a German turbine to Spain is treated as an import in Spain). In this case 75% of the European added capacity in 2018 is imported, yet 5 to 9 percentage points less than in the period 2010-2012 (Figure 45).

|

||

|

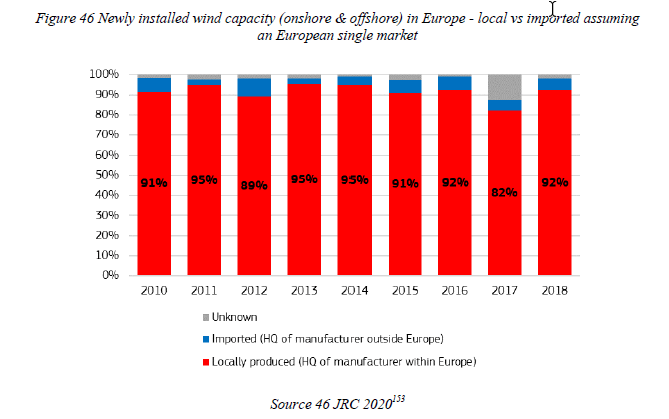

The picture changes significantly when assuming that the EU28 as a single market. In this case, the share of local European production is found at 92% in 2018, a similar value as in the previous years153.