ESSAY 1 Featuring Jeffrey Gundlach

By John Mauldin

“The moment of truth has arrived for [the] secular bond bull market! [Bonds] need to start rallying effective immediately or obituaries need to be written.”

—Jeffrey Gundlach

“Jeffrey started his career as a nearly broke rock and roll drummer, now he goes under the nickname the Bond King. What he says and does literally moves markets”

—Bethany McLean

Welcome to the first installment of this five-part series on the individuals and ideas informing my worldview as of late. My goal with this series is to highlight the ideas which have been deeply influential on me, and share with you what I’ve learned.

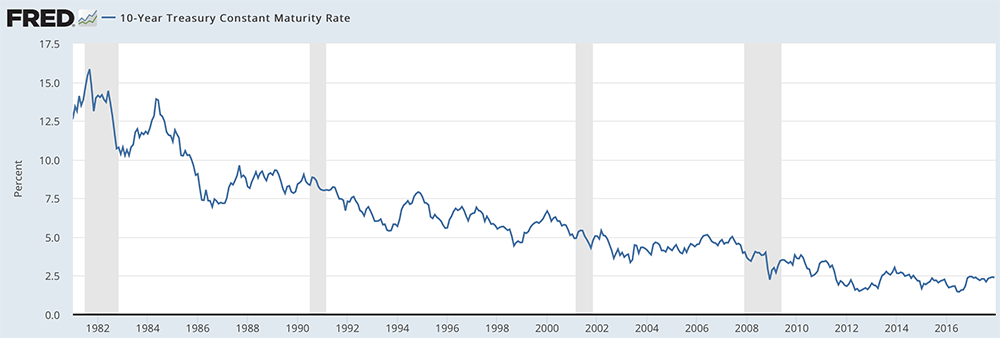

I mentioned in my email to you yesterday that this series will start with a bang, and the following fact certainly hit me like a ton of bricks: Anyone who started investing after 1981 has never experienced a bear market in Treasuries. The vast majority of today’s investors have only ever invested when Treasury yields are falling.

Sources: St Louis Fed

The secular decline in bond yields is one of the most definable trends in financial markets, and also one of the most important. As you know, US Treasury yields are the bellwether for global interest rates. Almost every market and asset class in the world is affected by them.

At every opportunity, I like to point out that interest rates are the cost of money. Unfortunately, at 68, I’m old enough to remember when the cost of money was high.

In the early 1980s, I took out a business loan with an 18% interest rate. The repayments were no fun, but I was one of the lucky ones who could actually afford to borrow money at that time. Those rates created an insurmountable hurdle for most entrepreneurs, and banks were not willing to lend like they are today.

In the 36 years since then, the cost of money has fallen sharply—and demand for it has skyrocketed. Today’s US financial infrastructure is addicted to “easy money.”

- Government: Low interest rates have enabled the Federal government to increase their total debt by 113% since 2008, yet interest payments have risen by only 5%.

- Corporations: Corporations have borrowed huge amounts of debt to fund stock buybacks and increases in their dividends. Today, nonfinancial corporate debt is 79% higher than it was in 2008.

- Households: The New York Fed’s latest quarterly report on household debt showed that US households have a total of $12.96 trillion in debt outstanding. That’s $280 billion higher than the previous all-time peak in Q3 2008.

The US economy has become heavily reliant on easy money, which leads to the question, “what would happen if interest rates increased substantially?”

One famed investor who has explored this question is “Bond King” Jeffrey Gundlach. The man needs no introduction, but I’ll give him one anyway. Jeffrey is the CEO of DoubleLine Capital, where he manages $116 billion—and has a stellar track record. Jeffrey has outperformed 92% of his peers over the last five years. His flagship DoubleLine Total Return Bond Fund (DBLTX) has also outperformed its benchmark by a wide margin over the same period.

Although Jeffrey manages one of the world’s largest bond funds, he is an independent thinker who has courage and conviction in his beliefs—maybe because he comes out of left field. Jeffrey holds degrees in mathematics and philosophy from Dartmouth College and was once the lead for a new-wave rock band, back when Paul Volcker had me paying 18% interest on that loan.

Jeffrey has had an ultra-successful investment career and has been spot-on with market timing, especially in 2017. He has called the direction of Treasuries and the US dollar, to almost the exact tick.

However, by far his biggest call, possibly in his entire career, is that the secular bond bull market is over, and that the US 10-year Treasury yield will hit 6% by 2020.

I want to dissect Jeffrey’s thought process behind this call. Let’s look at the three reasons why he believes the secular bond bull market is over and that we are headed into a period of rising interest rates.

Growth is good, but not for bonds

In a December interview with CNBC, Jeffrey commented on the recent economic growth numbers:

We’ve had 2% real [GDP growth] for three quarters in a row. GDP NOW at the Atlanta Fed is around 3% for the [Fourth] quarter. It seems to me that interest rates should continue to rise as we move into 2018, because bonds don’t like economic growth.

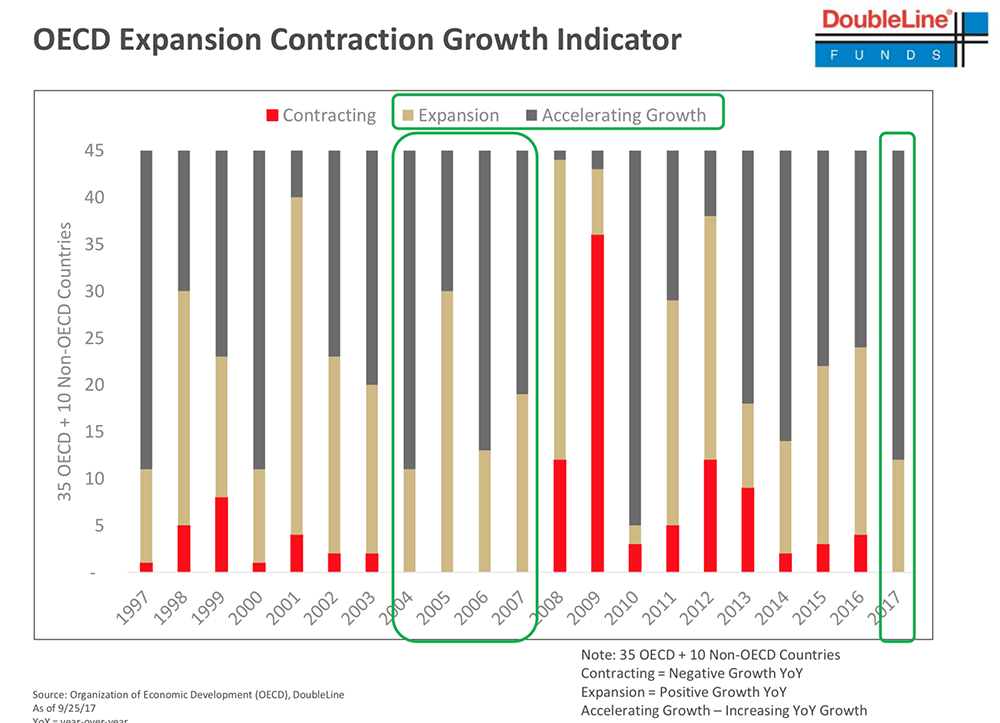

For the first time since 2007, not one of the 45 economies included in the OECD Expansion Contraction Growth Indicator is contracting. The below chart from a recent presentation Jeffrey gave shows this.

Sources: DoubleLine Funds

By this measure, the global economy is in a synchronized upswing for the first time in a decade—and the short-term outlook is positive. Leading economic indicators in all major regions are flashing green. In the US and Europe, the purchasing managers indices (PMIs) are at multi-year highs. This is good news for everything, except bond prices.

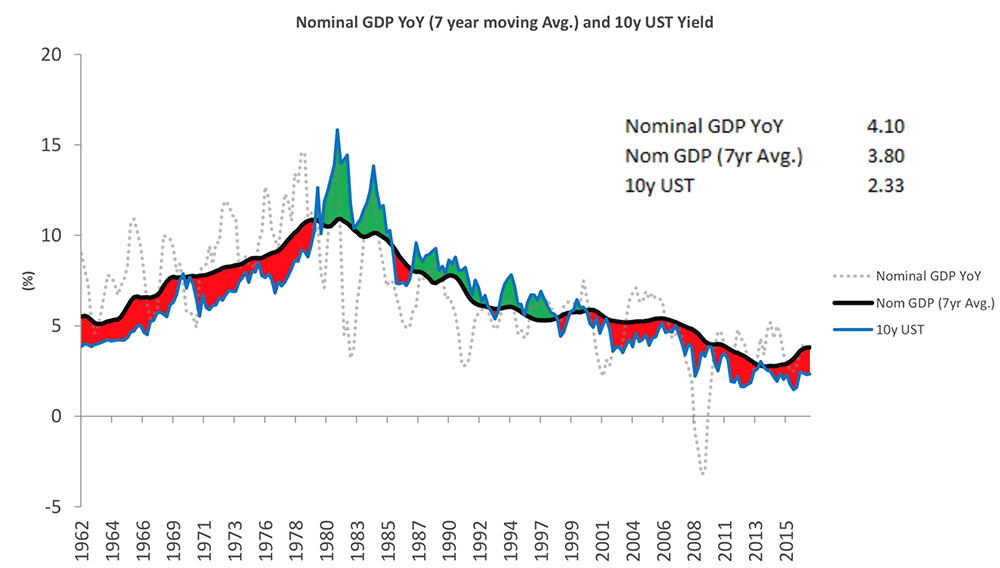

Higher economic growth means more demand for credit, which drives up its cost. In this case, the cost is interest rates. This relationship between economic growth and interest rates is why, over time, bond yields track nominal GDP growth.

The below chart from the recent presentation by Jeffrey shows that when the 7-year moving average of nominal GDP growth is higher than the US 10-year Treasury yield, yields should rise. The current setup suggests that bond yields should now be rising.

Sources: DoubleLine Funds

I have my doubts about the sustainability of growth in the US because of the rising debt burden and anemic growth in productivity and the working age population. With these headwinds, I believe it will be almost impossible to achieve sustained growth, like what we experienced in the 1990s. However, I concede that growth could continue to rise over the next 2–3 years.

Along with rising economic growth, Jeffrey sees the return of inflation as the second “building-block” to higher bond yields.

An arch enemy returns to the fray

In his December webcast, Jeffrey gave his thoughts on the current inflation numbers:

If [inflation] continues to rise, the Fed would have ample reason to follow through on its indicated three rate hikes in 2018.

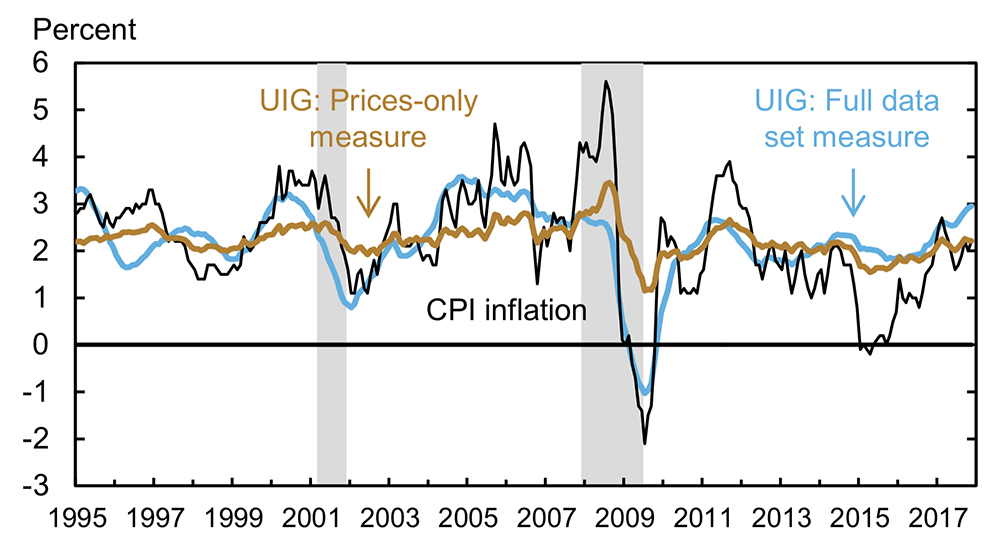

Despite the best efforts of central banks, inflation has remained largely absent from the US and other advanced economies over the past decade. In 2015, the US CPI annualized at just 0.11%. Finally, it appears that bonds’ arch enemy may be making a comeback.

Inflation, as measured by the CPI, is on track for its highest annual growth rate since 2011. It is also at multi-year highs in Europe, the UK, and Japan. Longtime readers know I have been a critic of the CPI, for a host of reasons I won’t go into now.

The indicator I use to get a broader, real-time measure of inflation is the New York Fed’s Underlying Inflation Gauge (UIG). This gauge captures sustained movements in inflation from information contained in a broad set of price, real activity, and financial data. In December, the UIG hit its highest level since August 2006, as the below chart shows.

Sources: New York Federal Reserve

We know that inflation erodes purchasing power. Therefore, if it continues to rise, bond yields will have to move higher to meet investor expectations. Remember, when the 10-year Treasury yielded 15% in 1981, inflation was running at 11%.

Since 1960, the average spread between the 10-year Treasury and the CPI is 2.4%. Today, it is just 0.15%. It’s likely to widen as investors’ inflation expectations increase.

Furthermore, at their December meeting, the Fed hinted that they are willing to let inflation run a little over their 2% target. Although they upgraded GDP growth, their forecast for three hikes in 2017 remained unchanged. Given that Janet Yellen once said, “To me, a wise policy is occasionally to let inflation rise even when inflation is running above target,” this is no surprise.

The last building block to higher bond yields, which Jeffrey has identified, is the coming tidal wave of supply in the bond market.

Price is a function of supply and demand

Jeffrey provided insight into how the supply and demand dynamics of the bond market are going to change in his December webcast:

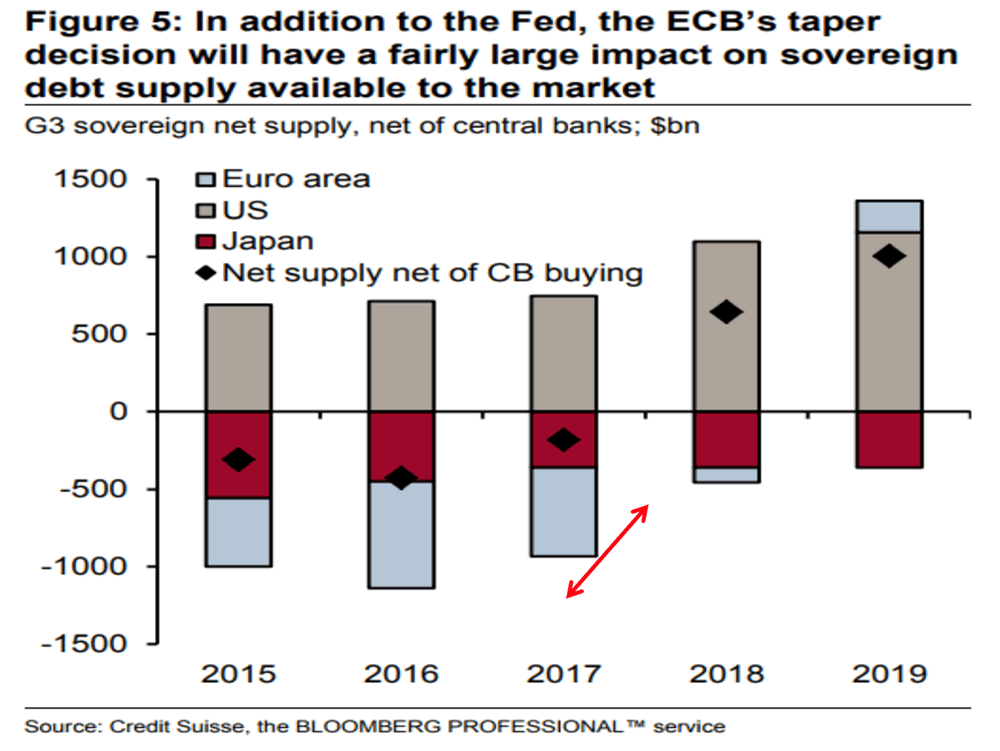

One thing that has helped rates stay low is the lack of [bond] supply. For the last three years, there was negative net supply of bonds from the G3 central banks, and that’s about to change with quantitative tightening. There is a lot of bond supply coming.

The third reason Jeffrey believes the secular bond bull market is over is the coming tsunami of supply about to hit the bond market.

By purchasing a huge amount of sovereign bonds through quantitative easing (QE), central banks have suppressed bond yields over the past decade. For example, demand for sovereign bonds exceeded issuance by around $250 trillion in 2017, thanks to QE by the G3 central banks.

With the Fed now reducing the size of their balance sheet by $30 billion per month, and the European Central Bank scaling back bond purchases by $20 billion per month, this dynamic is going to change, radically. There will be a shift from a $250 billion net demand in 2017, to a $550 billion net supply in 2018. As the below chart shows, that is quite a large swing.

Sources: DoubleLine Funds

There will be an additional $800 billion in sovereign bond supply in 2018, compared to 2017. Econ 101 tells us that this will push bond yields up. But central banks stepping off the gas is not the only trend that is going to contribute to a glut of supply in the bond market. We also have higher budget deficits to factor in.

According to the Congressional Research Service, mandatory Federal spending is set to increase $1.56 trillion by 2026. To pay for this additional spending, more bonds will be issued.

For me, the increasing supply of bonds is the most compelling reason for the end of the secular bond bull market. I have no doubt that quantitative tightening will cause interest rates to rise. Plus, increases in mandatory Federal spending are baked in the cake.

Along with providing reasons why he thinks the secular bond bull market is over, Jeffrey has given insight into how he thinks it will happen. One of his favorite anecdotes about how he sees it playing out is a famous dialogue from Ernest Hemingway’s 1926 novel, The Sun Also Rises.

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

In other words, interest rates will rise gradually over several years, and then everyone will notice, suddenly.

If Jeffrey is correct, and the secular bond bull market is over, the entire financial infrastructure will change.

For starters, how will the governments, corporations, and households who have become dependent on cheap money, react? In 2008, we saw forced deleveraging in action—and it wasn’t pretty.

What will happen to global stock markets if interest rates continue to rise? As Warren Buffett said in a recent interview, “Measured against interest rates, stocks actually are on the cheap side compared to historic valuations. But the risk always is that interest rates go up, and that brings stocks down.”

Now, a world with a 6% yield on the 10-year Treasury is hard to imagine. Saying that, if you had told me when I took out that business loan in the early 1980s that in 30 years, the 10-year yield would be less than 2%, I would have called you crazy.

Jeffrey thinks that we are headed into a much tougher environment because “the Central Bank balance sheets will stop growing at the beginning of 2018, [and] the liquidity that’s helped drive the market is going to reverse. That is not favorable for risk markets.” As such, Jeffrey and his team at DoubleLine have been de-risking their portfolios and have cautioned investors to do the same.

However, the Bond King is not bearish on everything. Jeffrey made a big multi-year call on emerging markets earlier this year and just came out with his top trade idea for 2018: add commodities to your portfolio.

Getting back to Jeffrey’s call on the end of the secular bond bull market, given its wide-ranging implications, it might be the biggest call of his investment career.

Where interest rates go from here will change how we invest and how society functions. I don’t think that’s an exaggeration given the amount of debt in the system and the expectations that the era of easy money will continue, indefinitely.

Because of this, I want to get Jeffrey’s most up-to-date thoughts on how it may play out, and what he believes the implications will be for investors and the economy. That’s why I’ve asked him to give a keynote speech at my Strategic Investment Conference in San Diego, next March.

Jeffrey is a truly independent thinker who is never afraid to make bold, out-of-consensus calls. That’s why I know when he takes the stage at the SIC, he will provide insight into much more than the secular bond bull market. I’m really excited to welcome Jeffrey back to the SIC, and I hope you can be there with me to experience it, first-hand. If you would like to learn more about attending the SIC 2018, and about the other speakers who will be there, you can do so here.

I’ll admit I was somewhat skeptical when you claimed it was the “best conference,” but after last year, I couldn’t praise the SIC enough to my colleagues. (I think they actually got tired of me talking about it.) As a principle, I try NOT to attend the same events but rather experience new and different forums. However, I couldn’t resist returning for the SIC and have once again talked the ears off my fellow traders on the desk.

—Danny A. (past SIC attendee)

That wraps up the first part of this series. In the next installment, you’ll get my thoughts on George Gilder and his new theory of economics.

Now I want to hear from you

If you have a moment, I’d like to get your thoughts and questions regarding Jeffrey’s call that the secular bond bull market is over.

If you have any questions or comments about Jeffrey’s big call, or this five-part series, you can post them in the comment section below.

Your wondering where yields go from here analyst,

John Mauldin

Chairman

![]()